At approximately 5:05 EDT, the Sep11 silver contract reached the $44 level. A few minutes later, it traded as high as $44.09. Thereby, another Turd prophesy has been fulfilled:

https://www.tfmetalsreport.com/blog/1993/silver-44

I'm just glad that's over with. I was in no mood to take another rash of sht from the losers at Kitco.

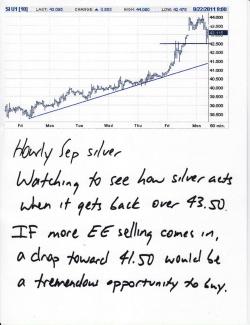

OK, back to business. The Forces of Darkness are in deep trouble in silver. This morning, silver is above all of its upwardly-pointing moving averages. This, when combined with the very friendly chart, is serving to bring all sorts of TA-oriented longs back into the pit. In a desperate attempt to contain the runaway, the EE predictably beat down silver in the wee hours of the morning. They were trying to close the gap on the chart from last night's open and they succeeded. Hurray for them. What did they accomplish? They're short a fresh boatload of silver contracts and the Sep11 is now back above 43.50. Whatever. Wait until tomorrow at this time. Or even Wednesday. I think we could see $45 before the shenanigans surrounding option expiry on Thursday begin.

As you can see below, gold has been subject to its traditional manipulation, as well. The seminal study of this phenomena was written by Adrian Douglas and it was posted to ZH about a year ago. If you have the time, I highly encourage you to read this:

https://www.zerohedge.com/article/guest-post-gold-market-not-“fixed”-it’s-rigged

In its present form, the manipulation discussed in the link above looks like this:

Like I said above, relax and smile. The PMs are headed higher today. Tomorrow, too. Gold came within a whisker of $1900 overnight. It will break that barrier soon, probably overnight tonight.

Have a fun day! TF