There's a lot going on and I'm diligently trying to connect all of the dots.

In fact, there are so many dots to connect, I don't know where to start. I guess we'll start with price. Surprise, surprise! The Bernank tipped his hand yesterday regarding QE∞ and really moved the markets. Stocks, bonds, the metals...nearly everything has rallied. The only victim was The Pig, which immediately fell over 2 points, which is an historic, monstrously large move. I don't ever recall seeing a POSX move of that size before. Amazing!

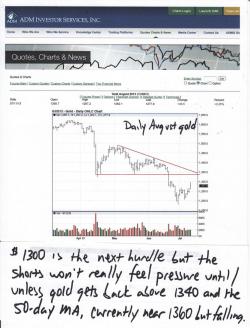

The metals have rallied but the shorts remain in firm control, at least for now. We got a bit of a panic squeeze in the afterhours late yesterday but, once London opened, things we're jammed back down. (Why anyone in their right mind buys gold futures between midnight and 2:00 am NY time is beyond me.) The charts look better and it's always nice to see some green on the screen but don't go getting carried away just yet. Momentarily clearing $1300 and $20 is nice but we really need at least $1350 and $21 before we can begin to get excited. Until then, just keep stacking your physical, a little bit at a time. For example, I ordered 50 ASEs late Tuesday. Glad I did!

OK, let's dig into the weeds a little bit and see what we find. LOTS of talk about the negative GOFO rates out there...which continue negative for the 4th consecutive day...which is unprecedented. What the heck does this indicate? My friend, DenverDave, does as good a job as I've seen explaining the implications. If you haven't yet, please take the time to read this: https://truthingold.blogspot.com/2013/07/gofo-explained-and-why-its-now-very.html

So, what other indications of shortage and backwardation are out there? Well, we've got this from Harvey:

"Tonight, the Comex registered or dealer inventory of gold falls below 1 million oz to 985,969 oz or 30.66 tonnes. This is getting dangerously low. The total of all gold at the comex (dealer and customer) falls again and registers a reading of 7.095 million oz or 220.680 tonnes of gold. JPMorgan's customer inventory remains constant at 136,380.609 oz or 4.24 tonnes. It's dealer inventory also remains constant at 401,877.493 oz but it still must settle upon contracts issued in the June delivery month which far exceeds its inventory. The total of the 3 major gold bullion dealers( Scotia , HSBC and JPMorgan) in its Comex gold dealer account registers only 26.03 tonnes of gold. The total of all of the dealers falls to 30.66 tonnes!! And tonight, Brinks dealer inventory falls to a record low of only 4.18 tonnes of gold!!"

Let's see...The Banks only show 30.66 metric tonnes of registered (approved and ready to be delivered) gold. This may sound like a lot but it's not. Check these two charts below:

These two charts came from Jesse's site and he's got a terrific piece on the subject that you should read by clicking here: https://jessescrossroadscafe.blogspot.com/2013/07/registered-gold-on-comex-breaks-million.html

So, inventories are extremely low and falling. The Bullion Banks (at least the U.S.-based ones) are now demonstrably long Comex gold futures. And now we have negative GOFO rates which seem to indicate a true tightness and lack of desire to part with physical gold, even in the face of an easy short-term profit. What the devil is going on here? Are we finally seeing the entire fractional reserve bullion banking scheme come apart at the seams?? It certainly appears that way.

And now to the title of this post. It appears, on the surface at least, that JPM is aggressively hoarding physical silver. Uncle Ted and Andrew have been all over this for some time now. Let's review. First Andrew.

Again, even if you're not an active trader, being a member of "Turd's Army" is well worth the money. Besides an ongoing daily commentary with instant notification of any trades he makes, Andy writes up a weekly commentary which he publishes every Sunday. This is, hands down, the most important and valuable newsletter you will ever receive. If you'd like to sign up, click here: https://www.coghlancapital.com/daytrades-application?ak=turd_army. Anyway, Andy has been noting to subscribers that, for about the past three weeks, there has been a large, institutional buyer appearing at each and every London silver fix. Because of the size of the orders, this buyer could only be a Bullion Bank and he has deduced that is likely JPM. So, if Andy is correct (and I have absolutely no reason to doubt him), then suddenly JPM has taken to quietly acquiring as much physical silver as they can.

Now, add to that what has been going on this month at The Comex. Uncle Ted (another simply outstanding newsletter you should take: https://www.butlerresearch.com) has been all over this since the first of the month. Back on Saturday he wrote this:

"I believe the statistics from the first six days of the July COMEX silver futures contract provide enough data for attention. The standout feature for the first week of deliveries against the July silver contract indicates that JPMorgan has taken roughly 90% of the metal offered for delivery, or a total of 1637 contracts out of a cumulative total of 1828 delivered so far. In turn, of the silver contracts stopped or accepted by JPMorgan, 90% (1479 contracts) were for JPMorgan’s own house or proprietary trading account. In other words, JPMorgan took delivery of roughly 7.4 million ounces of silver in the COMEX warehouses for their own benefit and risk".

He followed that up yesterday with this:

"A quick note on JPMorgan’s unusual taking of delivery of silver in the current July contract I first mentioned on Saturday. In the two delivery days since that review, JPMorgan has taken (stopped) an additional 369 contracts, 350 of which were for the bank’s house or proprietary trading account. Of the 2220 total contracts delivered so far in the July COMEX contract, JPM has taken 2006 contracts, including 1829 contracts for the bank’s own house account. Over the past two days, customers of JPMorgan have delivered close to 200 silver contracts as well, raising the question if JPMorgan is double dealing. Another point is that the 1829 contracts (9.145 million oz) that JPM has taken in its own name is above the level of 1500 contracts that COMEX rules dictate can’t be exceeded in any one delivery month by any single trader. Hey – have you ever heard of a rule or regulation that JPMorgan couldn’t evade? Me, neither."

There are still about 1,200 July contracts that remain to be settled so we'll see where those go...but what the heck is going on here? Of the 2,220 July13 contracts that have been settled so far this month, JPM has claimed over 90% of them. Further, 90% of those have gone directly into JPM's own house account!

So we've got JPM soaking up as much Comex silver as they can without disturbing the price downtrend AND we've also got JPM appearing each day at The Fix, buying up as much silver as possible there, too. Connecting these dots leads me to this conclusion:

JPM is getting out of the silver manipulation game. Perhaps they've been warned by the CFTC. Perhaps they simply see the writing on the wall. Again, it's impossible to say. What we do know is:

- During this 9-month decline, they've trimmed their naked Comex short position from roughly 35,000 contracts down to approximately 15,000 contracts.

- The startling, surprising and historic rise in the "other commercial" gross long position from 40,000 to over 60,000 contracts has likely prohibited them from reducing their naked short position to zero.

So, JPM sees the writing on the wall and is left with three choices:

- Cover the rest into rising prices. They tried that in 2011 and it didn't work so well.

- Go the "potato" route and simply default on delivery. https://www.tfmetalsreport.com/blog/4348/simplot-scenario-silver

- Continue to cover the naked shorts as much and for as long as you can BUT also acquire as much physical silver as possible so that you actually can physically deliver against all your short paper if it comes down to it. If you're short 10,000 contracts and suddenly those 10,000 longs stand for delivery, it would greatly benefit you to actually have the 50,000,000 ounces on hand. Settle it out and it's over.

Again, this is just a hunch...an attempt to connect some dots. Let's watch this situation closely as we head through the month and see if it continues to play out.

Just a couple of other items. First, Pat Heller has written an excellent piece called "Where's The Gold?". You should read it: https://www.coinweek.com/bullion-report/wheres-the-gold/ And, speaking of "where's the gold?", our CBC documentary from back in April is finally set to make its American premiere on Saturday. It will debut on The History Channel known as "H2" and it will be shown at 10:00 pm EDT Saturday night. https://www.history.com/schedule/h2/7/13/2013

Lastly, I had a 30-minute conversation with Felix Moreno of GoldMoney back on Tuesday. They've now released it as a podcast and I think it turned out pretty well. It's worth a listen, even if I do say so myself.

That's all for now. I hope you have/had a great day!

TF