Most of us have been baffled over the years by the almost daily withdrawals and additions to the primary metal ETFs, GLD and SLV. There are seemingly no correlations to price movements, just additions and subtractions of inventory without basis in fundamentals. Today, we attempt to solve this riddle.

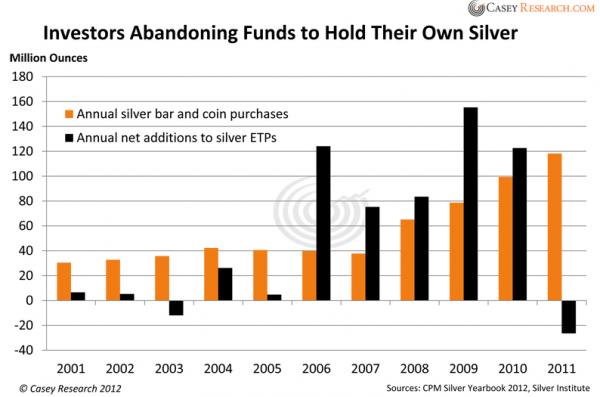

The daily metal movements into and out of the funds is only a small part of the much larger trend. Do you recall these charts from the HardAssetsAlliance and Casey Research? They show that, even while prices have increased dramatically over the past three years, net additions have fallen precipitously.

The key word above is "NET". While there is clearly some metal flowing into the funds over time, there is also a tremendous amount that is being withdrawn. The question then becomes: Which firms make withdrawals and why?

I posed this question to our friend, Andrew Maguire, and asked him for an explanation. Are these withdrawals a normal part of the day-to-day operations of an ETF or is there something more nefarious going on? Are the Custodians and Authorized Participants simply managing the funds and their own risks or are they using these stores of metal as a vehicle to suppress price and meet the ever-increasing demand for physical metal?

What follows below is Andy's answer. He laid this out for "Army" members a couple of weeks ago and he has generously offered to share it with you today. The hope is that by gaining an understanding of the inner workings of this process, you will have a greater appreciation of the true depth of metals markets manipulation and price suppression. The Bullion Banks are currently playing every possible angle in their increasingly desperate attempt to maintain power and preserve the current Comex/LBMA system. Though simple supply and demand dynamics dictate that they will ultimately lose this fight, they are certainly "going down swinging" and may even bring about a permanent change in the global financial system as a result.

____________________________________________________________________________

{As an aside, Andy's weekly commentary and Paul Coghlan's daily technical analysis are just two of the additional services that Army members enjoy when they enroll in the program. I feel that I cannot recommend this service emphatically enough. It is essential to your comprehension of daily and weekly events in the metals. Additionally, if you're attempting to trade these markets and you're not utilizing this service, you're crazy! Andy has over thirty years of experience trading and working the paper and physical markets. His willingness to share this experience with Turdville represents an exclusive and once-in-a-lifetime opportunity to work with, and learn from, the best. More can be found by clicking here: https://www.tfmetalsreport.com/podcast/3621/tfmr-podcast-16-special-anno... and here: https://www.coghlancapital.com/daytrades-application?ak=turd_army}

_____________________________________________________________________________

THE PRICE SUPPRESSION MECHANICS OF GLD & SLV

The bullion banks finance their ‘physical inventory’ by leasing it or selling it to GLD and SLV shareholders/investors, then the bullion banks in turn use these ETF’s inventories as a ‘flywheel’ to both manage and leverage their physical reserves. For this walk-through, I will use GLD as an example. (One can substitute SLV for all that is described below relating to GLD except the basket sizes are smaller, constituting 50,000 shares).

Baskets of GLD shares are bought and sold through a limited number of Authorised Participants. The authorised participants, (AP’s), are JPMorgan, Merrill Lynch, Morgan Stanley, Newedge (a joint venture between Société Générale and Credit Agricole CIB), RBC, Scotia Mocatta, UBS and Virtu Financial. This is how it is supposed to work. The size of each GLD basket comprises of 100,000 shares, each share representing just less than 1 troy oz. The AP’s, transfer ALLOCATED physical gold to the trustee who in turn creates the required number of new baskets of shares and then transfers these newly created shares back to the AP. To redeem the shares for physical gold or silver, the AP’s transfer any number of the baskets of 100,000 shares back to the trustee who then redeems these shares and transfers allocated gold back to the AP.

This is all well and good on the face of it, but there are a number of ways this ‘allocated’ gold backing the shares in the ETF can be diluted /hypothecated in order for the bullion banks to ‘manage’ their physical reserves.

If, as is often the case, there is insufficient allocated inventory available to the bullion bank at the current Comex driven & discounted spot fix price to create the necessary new GLD shares backed by allocated gold, then it is possible for a bullion bank to borrow short these GLD shares from the ETF instead of providing the required Allocated physical to the trustee to meet this obligation thereby ‘fly wheeling’ this physical demand in order to meet obligations elsewhere, likely at the day’s gold fix. This obviously has the effect of manipulating price lower vs. the true immediate supply demand fundamentals as no allocated physical metal has to be bought on the open market at that days fix to meet this new share demand as should be the case.

This is now the point where transparency evaporates. The AP claims to be Short GLD while concurrently claiming to be backing it with an equal size long ‘UNALLOCATED’ spot gold position. However, LBMA unallocated gold accounts are run upon a fractional reserve requirement and leveraged around 100/1 so there is very little need to back this transaction with any real physical at this point; this is left until later as explained below. To unwind this short GLD position, the bullion bank has to ALLOCATE the required amount of unallocated gold and then transfer this gold back to the trustee thereby receiving back the required # of shares in order to repay the original GLD shares sold short.

However, in conjunction with concurrent concentrated short futures positions, the sole object of this entire charade is to assist in depressing the price of gold at times of strong physical demand so that the futures price can be capped, usually at key inflection points where the price would break out and also swamp the very large concentrated Comex short positions. If this were not the case, the bullion bank would simply bid up that days fix price until it reflected that days true supply demand price levels for that fix and provide allocated gold to meet this real demand at that higher price.

The resulting distortion now created between the real and paper market price is exacerbated through the use of heavy position concentration and leverage in the futures and derivatives markets, where these very same bullion banks then seek to profitably repay the shorted GLD shares at a lower price at the point at or below where the lines cross profitably. This then puts these bullion banks in a position to finally spot index UNALLOCATED gold against this naked short position only then moving to buy the now discounted unallocated gold into the Comex contrived dips. These discounted unallocated long spot index positions are then ALLOCATED at the upcoming fix, enabling both the repayment of the GLD short position at a profit but most importantly controlling the rise in price against much larger derivative positions elsewhere.

Conversely, as evidenced by the steady 12-year stair step rise in prices easily observed in the daily and weekly charts, despite this many-year capping, we have also seen an ever larger and untenable LBMA unallocated short positions grow to what I now consider to be extreme danger levels. The reason is as follows: When the Bullion bank needs to make good on the unplanned/unanticipated CB and sovereign physical allocations at the fixes, they have regularly achieved this by going long GLD vs. short/selling UNALLOCATED gold. They then immediately turn around and transfer the required number of baskets of GLD shares to the trustee and receive ALLOCATED gold in return. Instead of settling/covering the short UNALLOCATED leg with this ALLOCATED gold, they are forced to satisfy these CB and Sovereign allocations by providing them this metal instead. The longer term price charts reveal this stair step higher, whereas we see no reduction, in fact from 2008 an increase, in the naked short Comex, (and unallocated OTC), bullion bank positions.

I hope this has been helpful in providing an insight into the internal dynamics of the ETFs and how the bullion banks continue to operate in the shadows.

A.M.