Understand this is just one trading and investing Parrot’s opinion, but I have read numerous interpretations/spins/takes on the GDXJ rebalancing, the JNUG implications, and none of them have seemed to me to honestly get to the core issues or implications of this major event as regards the immediate future of the junior mining sector (and possibly the entire sector as a whole, in the short-term). So in this piece I thought I would lay out, part by part and fact by fact, what I think might be implications that nobody is really talking about, either because they have vested interests in the sector and are afraid of spooking investors, or because they simply haven’t thought through the implications or imagined what may happen if the dominoes fall. Understand that this is speculative, but also understand that to dismiss this thesis, you must factually explain why the ‘cause and effect’ I am about to lay out will not take place. It is not my intention to discourage or frighten people, simply to warn them of a possibility that seems to me to be entirely realistic based on current fact and evidence. If I am wrong or in error, I gratefully welcome different interpretations of the data- the entire point of this is for all of us to do well in the end!

The Summary Case in a Nutshell:

- GDXJ, which already is 5% GDX (not juniors) and contains other significant holdings that are not really juniors as well, has now announced a rebalancing June 17th whereby they will be selling a long list of smaller junior miners (and not buying more) and adding larger-cap companies to their index. In short, this “junior mining” ETF is becoming essentially “10% large miners, 50% mid-cap producers, 40% larger juniors” ETF. The juice that used to be provided by the smaller miners is now either gone or at least largely diluted.

- This announcement will hit a big list of small mining companies in two ways. First is the obvious disgorging of GDXJ shares (representing 2.6 billion dollars of selling, or about 6-8 trading days-worth of share volume per company, all selling that has to be absorbed the market). The second, however, is the double-whammy this has on each of these companies in that (a) individual investors are/will sell their shares in anticipation of this, and (b) it will discourage future investment in these companies since everyone knows you cannot count on that big flow of GDXJ money ever coming back in to these stocks. This will depress the entire sector as a whole to some degree. Say goodbye to that easy pension, casual investor, and 401k money. From now on, those companies are niche investor targets only. Bad sign.

- JNUG, the 3x ETF based on GDXJ, has been the “risky bet” trading vehicle of choice for traders who want high risk/high reward exposure to gold, so much so that JNUG is now a 1.2 billion dollar behemoth. JNUG, however, leaks value vs the underlying GDXJ over time and this is reflected by a forthcoming 1 for 4 reverse split in the shares. It is feared that this split may signal even more leakage, putting traders on edge.

- The GDXJ rebalancing away from the juniors means that going forward, JNUG will not offer anywhere near the “juice” to traders it once did in terms of 3x exposure to the potentially fast-moving small junior stocks. Without this additional pop, why trade or hold JNUG? Why be in this leaky vehicle where the underlying GDXJ has torpedoed its underlying portfolio by (a) announcing its sales ahead of time and (b) essentially moving away from the very thing (exposure to the potentially high-flying small companies) that once made it attractive? These things will likely cause traders to move away from an increasingly sluggish JNUG.

- If traders leave JNUG, it will be devastating to GDXJ- the swaps and futures that allow JNUG to function represent roughly HALF the market cap of the 5.3 billion dollar GDXJ. If traders decide JNUG is no longer the rocketship it once was and hence is not worth the trouble, and just 20% quit trading JNUG, this is the equivalent of half a billion dollars fleeing GDXJ… if 40% quit trading JNUG, it’s the equivalent of a billion dollars exiting GDXJ. These types of outflows, in a short period of time, could mean serious price carnage in such a small sector.

- The thesis of this piece is that this chain of developments has the potential to devastate the junior miners in the short run, coming on top of the effects of the GDXJ rebalancing.

What did they know, and when did they know it?

This decision didn’t happen overnight. The folks who run GDXJ had to have made this choice, and understood the potentially deadly ramifications for the entire sector, quite some time ago. I think I know when.

Back in February I saw something in the charts that truly baffled me, a disconnect of a magnitude that I haven’t seen in 15 years of pouring over gold, silver, and mining charts on a near daily basis. There was a startlingly odd disconnect between the miners and the metals, when from Feb 10- Feb 26 Gold was up 3.6% yet the juniors were down 8%!!!

This bizarre, counterintuitive move was capped off by the big smash in miners on Monday, Feb 27 when GDXJ was hit for an additional 11% in a single day. When gold is flat over ten trading days, yet the juniors and down a whopping 20% over that same time on no news, something is definitely up. What is interesting is a tidbit our fellow Turdite Murphy sent me. In the final 15 minutes of trading that day of the big drop, Monday Feb 27, 775 million dollars of GDXJ shares changed hands... That is equivalent to the entire average daily volume of shares traded in that ETF in just the final 15 minutes of trading. On “no news”.

This is pure speculation, but I think this time period is when this decision was made- in a rising gold market, the juniors fell by 8% and ultimately 20% for no particularly good reason known publicly. This is when big money got out, and left us holding the bag. Sorry, but we are the last to know and that’s how it works.

The rebalanced GDXLCMCPBSM: The GDX Large Cap+ Mid-Cap Producers+ Bigger Small Miners fund

GDXJ already holds GDX. Everyone has seen the new rebalancing lists by now, but if you haven’t, here are the links.

The GDXJ adds: https://themacrotourist.com/images/2017/04/AddsApr1917.png

The GDXJ drops: https://themacrotourist.com/images/2017/04/DeletesApr1917.png

Scotiabank estimates that the 23 new additions will ultimately constitute 63% of GDXJ. https://www.nasdaq.com/article/gold-miner-etf-gdxj-to-undergo-dramatic-change-cm775363#ixzz4euPdSaWl

From the above article, here is the quote that should send chills through every owner of a small mining stock: “The fund will see dramatic offloading of current index components to fund the new additions. Scotiabank estimates that the fund could have to sell .6 billion of fund assets, representing approximately 2.5-8% of each individual existing component.” How is a market as small as the juniors supposed to absorb 2.6 billion in selling without major price disruptions? I think this explains the February sell-off… inside money knew this was coming, and already sold.

Let’s be honest: JNUG is a gambler’s ETF

The reason JNUG has grown into a billion dollar ETF is simple- greedy people like me (and you) look at last Spring’s rise and start doing the math, and say “If gold went from 1048 to 1375, I could have bought GLD and made 30%... but JNUG went from 2 bucks to 32”. We start thinking that we can invest 20k and turn the next rip in gold into a 16 bagger in 4 months, and turn that 20k into 0,000. Honestly, we should admit that is the only reason people buy JNUG, and put up with the decay vs. the underlying over time. With the new changes to GDXJ that simply isn’t going to happen anymore. And when people realize this, it will be a problem. Maybe a billion dollar problem.

Scotiabank also estimated that as much as 50% of the 5.3 billion market cap of GDXJ is due to JNUG, and the complex strata of swaps and futures needed to get that 3x leverage to work. If people leave JNUG because GDXJ has turned itself into a boring, vanilla mid-cap fund, and because they cannot in any way reasonably believe they can replicate that stirring 16 bagger we saw last year, then GDXJ could be in deep trouble. If just 20% of “investors” (gamblers) quit JNUG that is a half-billion dollar outflow from GDXJ, at least. If 50% leave it could reasonably be a 1.1 billion outflow from the junior mining sector… and that is ON TOP of the already massive 2.6 billion dollar outflow from the companies on the GDJX “cut list” mentioned above. You see the potential for carnage yet? This just isn’t a big enough sector. In a period of a month or two it simply cannot absorb such outflows without massive price disruptions.

Proof of Concept?

One of these things is not like the others…

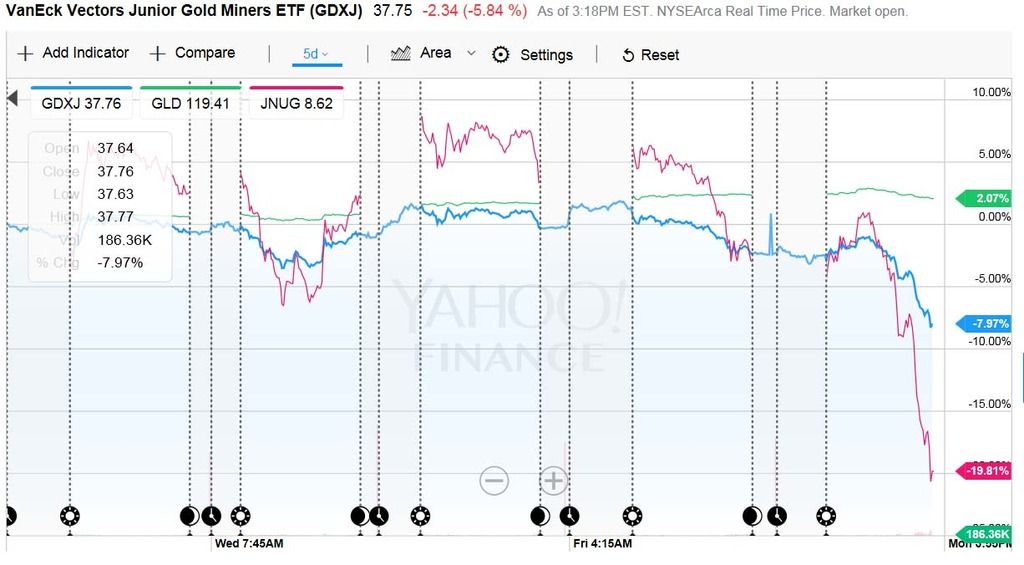

Gee, it's almost as if, sometime around April 11-12, something happened that disconnected JNUG (or more specifically, the underlying GDXJ) from the normal flow of market forces affecting the other 3x instruments- something that was truly specific to that instrument, and made it deeply undesirable to investors, who started to flee it in droves....

In addition, JNUG and JDST should mirror each other. Instead, they have started to diverge, by a whopping 5% as of Thursday:

Since the infamous April 11-12 GDXJ rebalancing announcement, coming on top of the looming 1 for 4 reverse split already announced for JNUG, the gap between JNUG and it's supposed opposite JDST continues to widen. As of price at the time of my posting this, in just the last five days the difference between the two has grown to 5.28% in just five trading days!!! Note that during that same time, NUGT and DUST are holding their normal inverse relationship quite closely as they should, so it is just these two... all while gold (even expressed in UGLD) is basically flat. People leaving the miners, and FLEEING the juniors:

When Van Eck announced JNUG "suspension of issuance of new shares" and they added that it might mean that it will trade "at a premium to NAV", I posted here at the time that they did this to try and hold the short sellers at bay if they could, and to stem or somewhat manage the carnage they saw coming. The premium to NAV bit was just misdirection to pretty it up. This attempt to artificially prop up JNUG likely accounts for the 5% + difference between JNUG and JDST...

So without the prop of not issuing new shares, only buying back - thus shrinking supply somewhat (which they can only do with cash on hand, till it runs out) then JNUG would be knocking on the door of a 25% drop... Think about that, if JNUG "should have dropped" 23.28% commensurate with JDST's rise, and JNUG swaps and futures represents 50% of the market capitalization of GDXJ, which is 5.3 billion, that is roughly 600 million dollars of market cap flowing out of the junior miners in just the last five days. It hasn't worked it's way through the system yet to truly move price since these are swaps and futures, but it may soon...

Is there a silver (and gold) lining?

Well, if you are a complete optimist you could argue that between the 20% Feb/March drop prior to this becoming public knowledge, and the time since then which has included the above drops in JNUG and GDXJ, that much of this may already be largely priced in. Obviously, I don’t think so, and I believe the effects of the JNUG exodus are yet to be fully felt, but one could make the case that (a) that is overblown and JNUG will keep on trucking because traders don’t care and want their juice, and (b) the GDXJ hit is already largely behind us. So if you are of this mindset, perhaps this is the BTFD moment. Personally, this parrot is not counting on that. Time to batten down the hatches, mateys.