One of the primary themes that we've been repeating is that 2017 is going to be a wildly unpredictable year. To that end, today we begin what might be a wildly unpredictable week. Buckle up.

So, let's see. What are some of the primary tenets of the heavily-promoted "Generally Accepted Narrative"?

- Major US deficit spending will promote economic growth

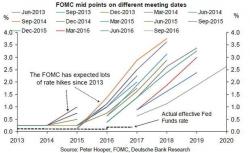

- This economic growth will allow The Fed to hike the Fed Funds rate 3-4 times

- Rates on the long end will rise, too, as "the bond bubble bursts"

- All of this growth and higher rates will prompt a huge rally in the dollar

- And the US stock market will charge toward 25,000 on the Dow.

Let's check in on these as we've now reached the second half of January.

"Major US deficit spending will promote economic growth. This economic growth will allow The Fed to hike the Fed Funds rate 3-4 times." -- Well, we'll see about this. There have not been any specific proposals put forth yet by Trump and some of the economic and confidence numbers are already beginning to roll over. Here's today's economic datapoint for your consideration: https://www.zerohedge.com/news/2017-01-17/trumphoria-fades-empire-fed-ma... And, regarding The Fed, let's not forget these two charts:

"Rates on the long end will rise, too, as "the bond bubble bursts". Well, this isn't working out so well for the Narrative Pushers. As we've been observing, long rates are moving lower as bonds are bought, not sold, and the so-called "bond bubble" is alive and well. As you can see below, since the first of the year, the rate of the 30-year Long Bond has fallen from 3.11% to 2.93% and now threatens a complete reversal back to where it was before the US election. Yes, we will continue to watch this very closely in the weeks ahead.

"All of this growth and higher rates will prompt a huge rally in the dollar." And here is where The Narrative Pushers are really failing. The conventional wisdom holds that the POSX is going to 110+ as the euro and yen both fade under the weight of their own issues. Well, not so fast my friend. As you can see below, The Pig has already fallen rather dramatically in January and, if it falls back under 100, the Pig bulls are really going to have to start questioning themselves.

"And the US stock market will charge toward 25,000 on the Dow." Hmmm. Not so much. Maybe Bob Pissonme and the rest of the CNBS cheerleaders should concentrate on getting to 20,000 before focusing upon 25,000? As you can see below, the "stock market" has been stuck now for over a month.

We see The Generally Accepted Narrative failing as it pertains to Comex Digital Gold and Silver, too. How many forecasts did you read in December that called for sub-00 gold? How many supposed analysts and wave-counters were projecting or silver? Instead, that ain't working out so well. And why? Because the analysts and technicians all fail to understand that there is no "market" for "gold". Instead, we have HFT driving funds into and out of Comex Digital Gold exposure, primarily following changes to the USDJPY. Who cares of we're in subcycle F of major downwave 3? None of that mumbo-jumbo makes a rat's ass bit of difference if the USDJPY is indeed headed back toward 100.

So be of good cheer but expect a wildly unpredictable 2017. As we've seen so far, the predicted market moves of The Generally Accepted Narrative for 2017 are far from being a fait accompli.

TF

Recent Comments