The first trading day of the year certainly brought about some powerful rallies. As we've discussed in the past, trend changes can often be spotted in hindsight by looking for days where powerful, surprising rallies developed. Was today such a day? Only time will tell.

There's certainly a lot of interesting stuff going on. Let's try to take things one-by-one. First up, of course, is gold. As we've discussed since September, there has always been a possibility that gold could fall all the way down to its primary trendline. I had always drawn and speculated that that line was around 1550 or so. Well, after the close of last week and last month, take a look at this monthly chart. In the immortal words of W, "mission accomplished".

Again, a close inspection of this chart shows that gold tends to hug the lower line for a while once it reaches there. It has happened several times in the past three years. However, I fully expect this line to hold going forward so there would seem to be minimal downside risk at this point.

When we look at the shorter term charts, a couple of levels jump off the page. First of all, in the very short term, gold is likely overbought and subject to a decline tomorrow. 1605 will likely act as resistance and then 1585 or so will need to act as support. If support holds and then 1605 falls, gold will make a run to 1620 and then 1640 before pausing. Once those levels are bested, gold can begin to set its sights on the black line found on the daily chart. Once gold rises to that line, The Battle Royale will begin. Ideally, by later this month, gold will reach the line and trade up through it. It will then ride the line lower for a few hours/days and then skip away higher. At that point, I will get extremely bullish as gold will be headed to 1800 and then back to its old highs from September.

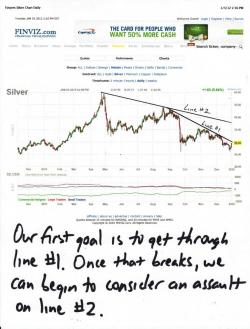

OK, now let's look at silver. Like gold, let's begin by looking at the monthly chart. Again, I've stated since September that the potential existed for silver to fall all the way back to the primary trendline. Back in September, the line was near $24. Today, it looks to be right at $25. Of course, the lows of last week could be the bottom. However, I have to think there is still a strong possibility that silver will make one, last push lower to touch this line. Time will tell. We'll keep watching the shorter term charts for clues.

Speaking of the shorter term charts, take a look at these two. First up, look at the hourly chart. Clearly $30 is an important level and one which the EE has tried to protect. Then, check out the daily chart and you really begin to get a sense as to why $30 is so important. IF silver can get convincingly above there, it will take out the downtrend line from the highs of early September. This would be a very important first step in the recovery/rally of the paper price. It may happen. I hope it does. However, I'm not convinced that the EE is ready for it to happen yet so do not be surprised if silver fails near 30 and slips lower. Let's watch this closely.

This would be a good spot to discuss some silver fundos. As I mentioned in yesterday's video, the latest silver CoT numbers are very intriguing. At the height of the silver rally back in May, the spec long position in silver exceeded 45,000 contracts. Today, that number has been nearly cut in half to about 24,000. In contrast, the bank long position in May was around 36,000 contracts. Today that number stands near 41,000! Clearly, these are extremely bullish statistics and exactly what I would be looking for, from a CoT perspective, at an important bottom. These numbers don't mean we are at the bottom but they do indicate that we are very close.

Now let's turn our attention to our old friend, Pigatha Christie. Take a look at this chart and have a laugh. Note that the POSX is almost exactly where it was a year ago. In fact, almost exactly a year ago, on the old blog I wrote about how the coming decline in The Pig would impact PM prices. It's a must read if anything to see how little some things have changed in a year, though certainly lots of volatility in between.

https://tfmetalsreport.blogspot.com/2011/01/dollar-shitcan.html

At any rate, the dollar looks to be topping again in the area around 80-81. If Q1 2012 plays out like Q1 2011, we'll certainly be in for another fun ride in the PMs.

We probably should take a look at crude, too. Note a couple of important things.

- Crude is at it's own "moment of truth". If it can move through 104, it will almost certainly move toward 115.

- Note how similar the crude chart is to the silver chart. Similar, that is, until early October. At some point, they will re-sync. The question is: will crude trade down to silver or will silver trade up to crude?

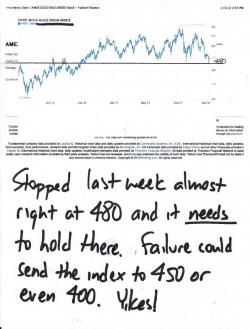

Finally, I suppose we should check the chart of the HUI. Before we do, however, I now have to post this link. I can't type "HUI" without thinking of this song as it sounds to me that the lyric actually says "HUI". (Frankly, it's just a gratuitous reason to post a video of Carrie Underwood. Mmmm.)

OK, back to business. Here's your chart. Note that the index stopped right near its bottom target of 480 last week. That should be it. Let's hope so because any drop through 480 and we'll have to look for 450 or even 400. The poor miner holders are already suicidal. A 400 HUI might push them over the edge.

OK, that's all for now. I have to take LT#2 to her Tae Kwon Do lesson. I hope you all have a great overnight. Let's see what happens. Tomorrow should be a rather interesting day.

TF