It what can only be construed as encouraging action, gold flew back higher today, nearly to the level it was before the blatant manipulation of Wednesday. I'll be very interested in the OI numbers tomorrow to see if today was primarily due to continued short covering by The Cartel.

I'll find it quite amusing if it was. To think that the SNB deliberately tried to manipulate gold lower only to be thwarted by the greedy, frightened, short-covering Cartel is wonderful to consider. Sort of like having your two worst enemies declare war upon each other. I'll stay happily on the sidelines while I giggle at my good fortune. At the end of days, survival instinct kicks in and everyone turns on each other. Perhaps that's what we're seeing here.

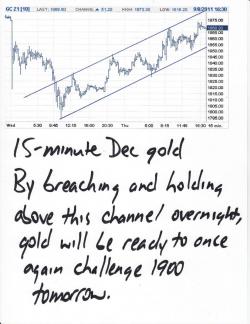

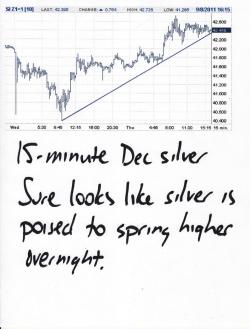

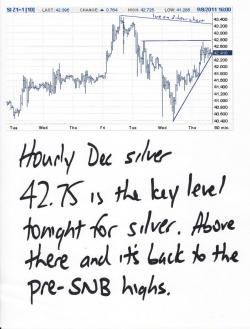

Regardless, The Turd is quite pleased with where we stand at this moment. Absent margin hikes or further intervention, the PMs look certain to trade higher this evening and into the overnight. (President O'bottom discussing the idea spending more money that we don't have should help provide the bids.) IF they can survive the usual 3:00 am LBMA beatdown, they will be poised for a stellar day tomorrow. Perhaps they will even finish with a green candle on the chart.

And if you haven't read this yet, I suggest you do it now. There's no sense in me commenting on it as I would imagine you can easily envision what I would say. (Something like "duh" or "ya think?" comes to mind.)

Have a great evening! TF