We were alerted on Tuesday to an interesting new development in the Physical Exchange Wars. While we all patiently await the arrival of the Allocated Bullion Exchange, the LBMA has clearly cast its lot and support behind something called Allocated Bullion Solutions. If this sounds fishy to you...well, you're not the only one.

Just a refresher...Allocated Bullion Exchange is the brain child of Tom Coughlin, CEO of Bullion Capital. This new exchange, which is still coming by the way, seeks to make the paper-based LBMA obsolete in the global "price discovery" process. We first brought ABX to your attention back in 2015 and you can learn more about it here: https://www.tfmetalsreport.com/podcast/6685/making-lbma-obsolete

The process of bringing this game-changing new exchange online has been daunting and delays have frustrated all of us. However, Tom has assured me that "2016 is going to be a big year" for ABX.

With this in mind, check out what our pal Ned Naylor-Leyland discovered earlier this week. In this month's edition of "The Alchemist", the LBMA's own magazine (and what a perfect name!), you'll find a lengthy introduction of a brand new exchange that is designed to help with the "wholesale physical markets" which are "broken". The article can be found on page 3 here: https://www.lbma.org.uk/assets/blog/alchemist_articles/Alch80Complete.pdf

Did you happen to catch the name of this new exchange...the one that the LBMA is so eager to publicize? It's called "Allocated Bullion Solutions"! Yep, that's right. Allocated Bullion Solutions versus Allocated Bullion Exchange. And the similarities don't stop there.

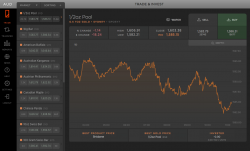

Below is a screenshot of the Bullion Capital platform that will likely be utilized within ABX. Take a good look:

Now compare that to this screenshot of the Allocated Bullion Solutions platform. Do you notice any similarities in color scheme and layout? I'm sure it's just a coincidence...

More details can be found at the Bullion Capital and ABX websites: https://www.bullioncapital.com/ & https://abx.com

And more details on the copycat ABS can be found here: https://www.allocatedbullion.sg

Here's the text of Ned's email from earlier:

I spotted an article in this months copy of LBMA rag The Alchemist entitled:

'Wholesale Physical Markets are broken'

https://www.lbma.org.uk/assets/blog/alchemist_articles/Alch80Complete.pdf

This piqued my interest (to say the least) seeing as it was in The Alchemist. Intrigued as to who the author Seamus Donogue is, we discovered that he is the principal of ABS (https://www.linkedin.com/in/seamus-donoghue-2504115a). Allocated Bullion Solutions. www.allocatedbullion.sg

Having dug about yesterday pm I can say with a good degree of confidence that ABS is the LBMA’s preferred version of the already developing, active and independent ABX. A brazen copy of the ABX model (including branding, imagery, the trading system etc) - except, crucially, as Seamus puts in his article:

'There would be no change in counterparties, clients, settlement processes or delivery locations'

Suddenly now when you google ABX you instead find ABS at the top of the search. The whole idea of ABX is that is it an anonymous allocated exchange that sits entirely outside the control of the LBMA, custody, settlement, etc.

I suspected that some attempt to block the impending disintermediation may be coming, as in April 2014 the Telegraph Business section mentioned that the LBMA were suddenly planning a modern electronic exchange to resolve the old-school nature of the Gold market. That Telegraph article came out a few short months after I first publicly discussed ABX/Bullion Capital and its potential for LBMA disintermediation on the Keiser Report.

As an extra aside, I particularly enjoyed Seamus' comment on Page 2:

'There are supply constraints in physical markets that do not exist in OTC markets...'

Ho Ho.

Ned

So, we'll see where this all heads from here. Clearly, the LBMA has recognized the threat that new platforms like the ABX pose and they are moving to squash the competition. Will they be successful? Well, I guess that remains to be seen. Hopefully, Tom will get his new exchange fully operational soon and we'll find out. In the meantime, understand and never forget that The Old Guard is fully invested in keeping/protecting their stranglehold on the global gold market. Anything that we can do to strike a blow to their efforts is a step in the right direction.

TF