Here is a news item from Zerohedge :

Link to the rest of the article: https://www.zerohedge.com/news/2013-03-24/another-gold-shortage-abn-halt-physical-gold-delivery

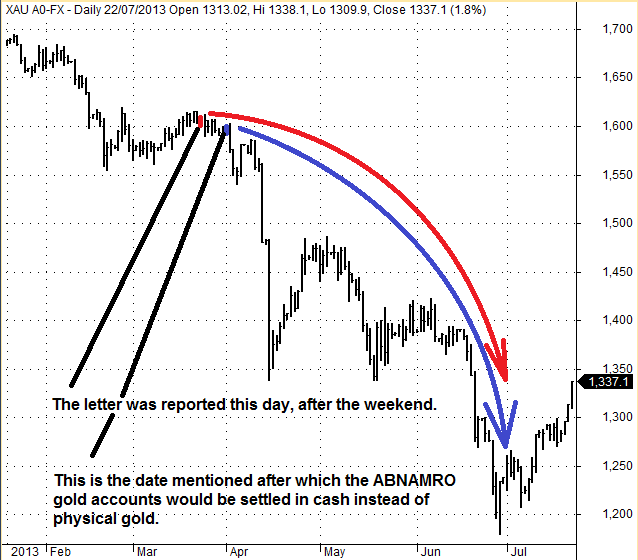

Please note the date of the article in Zerohedge was 24 March 2013.

So this sounds like gold that was in trust for clients had been rehypothecated, nay let us not use weasel-word bankster-speak, let us use English instead. How about: "stolen"," illegally converted to title of another party" instead? Alas I do not know the terms of the gold account contracts, so I can not be sure what was allowed and legal, or disallowed and illegal, or what was just shady sharp practise! So I must refrain from characterizing what was done last March to the gold account holders' gold. All I can surmise (from the bank's own letter) was that the gold was gone, or seemed to be so, and paper settlement would replace the obligation, or was that it?

So pretty soon the anti-bankster oriented alternative media jumped upon this news released .... err ... from ABN AMRO .... and did what they do best.

Now Dear Reader, if you receive news that a large bank can not deliver the gold (entrusted to them by their customer clients) back to those clients upon demand, well you might think that the gold is gone, and some freshly printed notes will be offered to clients instead, whereupon the clients would have to enter the gold market and purchase "their" gold back. It seems a reasonable and bullish way to interpret such information, doesn't it?

Well, let us look at the gold price in the period following this news release.

Here is a chart of what happened next:

Yes that is some coincidence isn't it? And 1600 minus 1200 = 400 which is a lot of money which changed pockets. A whole lot of money.

Now at this stage I should mention that people who made investment decisions based upon a letter written by a bank, and found in the public media (and there were a lot of them) may have learned something from how their trading system subsequently panned out. Something about what is and what isn't actionable information and what is and what isn't bait laid by the covert sales departments of large corporate entities who make money from trading assets. Maybe that letter was not for the adressees. Maybe it was for the public.

Still, Reader, I leave it up to you to figure out cause and effect in the byzantine world of gold pricing, and I will focus instead on a slightly different facet of the story than who made how much and how back in 2013. Let us look more towards the present.

One of the things which follows an investment pro selling at the top or a significant high, is that the pro usually gets interested in buying back the asset after the price has fallen by a large amount. They like to buy at the bottom, or near a significant low.

So if a lot of gold got sold to .. .err, the public .... at the beginning of a 200 dollar decline, then it might seem reasonable that when gold stops falling it might just be a teeny bit possible that maybe somebody is buying their gold back at a lower price.

So now I bring this little interview from Kitco. The first 4 1/2 minutes are quite relevant:

...." 144 million ounces of gold that came into Switzerland that stayed there".......

But, but, but ... why don't they want us to know this? We received no letter from the banks this time ! What would they do in silence?

Sherlock Holmes once solved a mystery based upon "the dog that didn't bark".

Here is an excerpt:

Quote: Gregory (Scotland Yard detective): "Is there any other point to which you would wish to draw my attention?"

Holmes: "To the curious incident of the dog in the night-time."

Gregory: "The dog did nothing in the night-time."

Holmes: "That was the curious incident." :Unquote

I can't remember if the dog's name was provided in Sir Arthur Conan Doyle's book, but, tongue in cheek, could it possibly have been called "Accumulation"?

Caveat emptor readers! It's just another gold market tale!

Argentus Maximus

The author posts daily commentary on the gold and silver markets in the TFMR forum: The Setup For The Big Trade. More information about the author & his work can be found here: RhythmNPrice.