It seems like I've got a whole bunch of stuff to cover with you but not much time to do it in. Let's get started.

First up...We've been waiting since Friday to get a peak at the open interest numbers. They were released on schedule this afternoon and below is a C&P of the summary I wrote in the comments section of the previous blog post. Always keep in mind that the OI data are 24 hours delayed so the numbers released today are as of the close Comex close back on Friday.

"Unlike the past couple of weeks, the numbers from Friday present a cloudy and confusing picture and they are going to require some guesswork on my part.

Let's start with silver because that was the number I was waiting for. Remember that Friday was a huge day in silver, up about $1.20 on the Comex and something like $1.60 by the close of the Globex. I was looking for a rise of just 500-1000 contracts because I felt the rally was primarily EE short-covering. If the rally was Sprott-induced, it should have been about 4000-5000 contracts. The actual number was 2350 as total OI rose from 102,055 to 104,406. Hmmm. What does this mean? Upon review and reflection, I think I am wrong and everyone else is right. 2350 is a lot of new open interest, particularly considering where OI is now versus April last year and taking into account the outrageous margin levels.

I think this implies a further rally in silver. A good rush of new money based upon the strong, Sprott fundamentals. $33 should only be a "speedbump" and silver should, instead, move toward $35 and onto the Battle Royale line near $37. Much more on this in the next blog post.

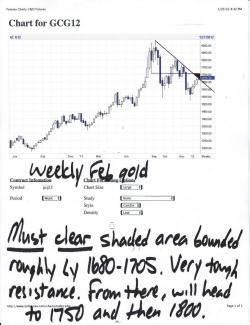

Now onto gold, which is even more strange. Gold was up almost $10 on Friday and had been seemingly capped and held below 1666 for about the 5th straight session. If this was indeed the case, we should have seen total gold OI continue to rise. Instead, total OI dropped by nearly 3000 contracts! This does smell like the short-covering I expected to see in silver. So what does this mean? Basically that Friday was an anomoly. The Cartel had indeed given up on holding the 1666 line and was intent on pulling back to a higher level. Thus we see the rise today that has outpaced silver and taken gold up toward 1680. From here, I expect a further rally on Happy Tuesday before The Cartel reasserts itself and attempts to stop gold dead in its tracks between 1690 and 1705."

So, why am I concerned about 1690-1705 in gold? The charts below will show you:

Silver has its own resistance to deal with. However, if I'm right about the "Sprott Effect", silver should soon move decisively through 33 and head toward 35.50. From there it will tackle the main trendline connecting the April and September highs. Once/if it gets through there, its Katy bar the door!

And, if anyone is wondering, lease rates continue to improve. The only negative rate now is the 1-month and all of the other rates are close to their 12-month highs. While not necessarily a short-term positive for gold, it definitely isn't a negative.

Those looking/hoping for QE3 should continue to closely monitor the declining POSX and U.S. treasuries. Right now, both are beginning to give indications that overt QE may be coming sooner rather than later.

OK, here are some important items for you to review in the overnight hours. First up, Ranting Andy wrote up a terrific summary for his daily email today. You should read the entire thing:

Our buddy, Jim Quinn, has filed another interesting article. It can be found here:

https://www.theburningplatform.com/?p=26210

We spent some time discussing the plunging Baltic Dry Index rate today. I suppose that every index has its nuances that effect how it changes over time...but...a drop of 50% in less than a month should get your attention, regardless. Also note that, at 860, the index is now at its lowest level since 2008.

https://www.bloomberg.com/apps/quote?ticker=BDIY:IND

Another item we covered in detail in the comments today was the story of India purchasing Iranian oil with gold instead of dollars. Here's another c&p of what I typed earlier:

Yes, Iran will likely exchange some of the gold for other things like gasoline. Some of the gold. Some. The main thing is this:

- Less global demand for dollars. Less demand + more supply = downward price (gold positive)

- India will certainly act to purchase gold to replenish supply "spent" on Iranian oil (gold positive)

- Another step on the path toward dollar irrelevance as reserve currency (gold positive)

And here is the original story from debka. If you don't like debka as a source, this was first reported on ZH about a year ago.

https://www.debka.com/article/21673/

https://www.zerohedge.com/article/india-offers-pay-iran-oil-gold

ZH printed this chart earlier today. I think it's fantastic! Note where 1913 falls on the chart (if you can't tell, it's about right in the middle):

Along those lines, a Turdite sent me this, which is pretty cool:

https://greshams-law.com/2012/01/22/a-century-of-b-s-fed/

And, lastly, our new buddy Jeff Nielson (I hope you enjoyed the podcast) just posted his latest missive on silver. You should be sure to take the time to read this, too.

OK, that's probably enough for now. We made it through Monday. What will tomorrow bring? I can't wait to find out!!

TF