Hmmm. I wonder how System Apologists like Moriarty, Christian, Hug and Weiner will try to spin this one?

In order to get this information out as quickly as possible, we'll save the price implications for later. But just today I saw this posted at Silver Doctors. I only post it here as a demonstration of typical Apologist garbage: https://www.silverdoctors.com/gold/gold-news/keith-weiner-weve-debunked-... So, given what you're about to read, will that author soon print an apology and retraction? Don't hold you breath.

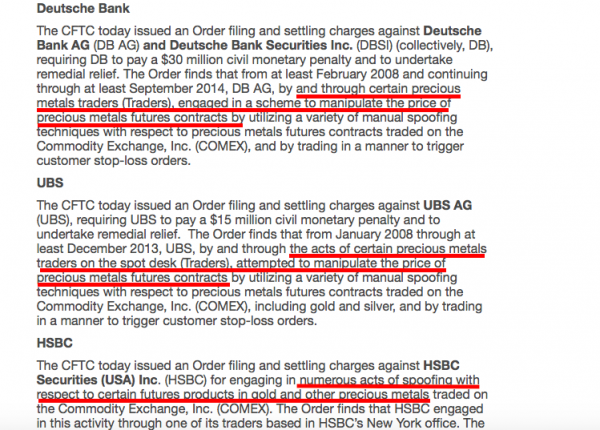

Late Friday, reports hit Reuters that the CFTC would soon levy fines for "spoofing and price manipulation in the futures markets". Well, just a few minutes ago, we got the news release. You can read it all here:

However, to save you some time, here's the most important section:

What about "ENGAGED IN A SCHEME TO MANIPULATE THE PRICE OF PRECIOUS METALS FUTURES CONTRACTS" is vague or open to interpretation? Not much. However, those who have based their careers and cash flow upon the notion that the precious metal markets are sacrosanct, free and fair just got themselves a cold slap of reality.

Will there be arrests and future charges against some of the US Banks? Meh, we'll see. Maybe. But that's a topic for another day. For now we await the response of those who have always claimed that we here at TFMR are nothing but tin foil-hatted simpletons who rely upon conspiracy theories to explain away things we're too stupid and unsophisticated to understand.

TF