If you've been a precious metals investor for any period of time, then you are likely familiar with the great work of Ronni Stoeferle and Mark Valek of Incrementum AG. Their latest, excellent research report is embedded here.

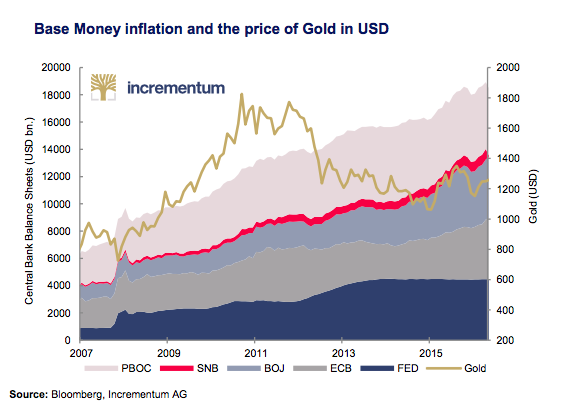

The report begins with these two paragraphs and this chart:

We live in an age of advanced monetary surrealism. In Q1 2017 alone, the largest central banks created the equivalent of almost USD 1,000 bn. worth of central bank money ex nihilo. Naturally the fresh currency was not used to fund philanthropic projects but to purchase financial securities. Although this ongoing liquidity supernova has temporarily created an uneasy calm in financial markets, we are strongly convinced that the real costs of this monetary madness will reveal themselves down the line.

We believe that the monetary tsunami created in the past years, consisting of a flood of central bank money and new debt, has created a dangerous illusion: the illusion of a carefree present at the expense of a fragile future. The frivolity displayed by many investors is for example reflected by record-low volatility in equities, which have acquired the nimbus of being without alternative, and is also highlighted by the minimal spreads on corporate and government bonds. Almost a decade of zero and negative interest rates has atomised any form of risk aversion.

I would imagine that this has piqued your interest enough to scroll through the report. If not, here another chart to whet your appetite:

Please take the time to read/review this terrific bit of analysis and research. Thanks again to Ronni and Mark for all their efforts and for their permission to post this report here at TFMR.

TF

In Gold We Trust 2017 Compact Version English.01 by Turd Ferguson on Scribd