Some say that everything you need to know you learned in kindergarten. I suppose that's true to some extent. However, to fully understand the forces at play in Comex Digital Metal, it might be good to review some of the basic economics that are often taught in introductory Econ classes at your local college or university.

Let's start with a chart. It doesn't really matter which one and, in fact, I just chose this one at random. Below is a one-week chart of the stock of Coca-Cola. Note that KO had some ups and downs last week but was mostly sideways in a price range.

And why was the price of KO shares moving sideways? At the most basic level, there were equal amounts of buyers and sellers in a period of fixed supply. Therefore, an equilibrium was reached and price was stable around $42.45/share. In your standard college economics class, it looks like this. Price is discovered where supply meets demand:

But you see that's not how it works on the Comex. There is never a period of fixed supply of futures contracts as The Banks issue and retire open interest on a daily basis. Complicating matters is the completely untethered nature of contract creation. Banks never have to deposit physical metal as collateral in order to sell paper metal short so they have the nearly unlimited ability to create as many contracts as they feel necessary.

What this leaves is a "market" where both the supply of the product (the Comex silver futures contract) and the demand for the product fluctuate on a daily basis. And with The Banks limitless ability to create new contracts, they're able to issue new contracts to meet demand whenever there is a spike in buying interest from speculators.

So now let's look at another stock from last week. Below is a chart of Amazon. Note the price rally over just five days. And why did price rise? Frankly, I have no idea of the fundamental cause of the rally. What I do know is this, however. Given that the amount of shares in the market for Amazon didn't change last week (supply), another chart from Econ 101 above explains the price rally. Increased demand for shares while the quantity of shares is held constant means that price has to rise to the point where current holders of shares were willing to part with them.

OK, are we all on the same page so far? Good. Let's continue.

Below is a chart of Comex Digital Silver that shows the price changes over the past week. Note that it looks a lot like the chart of Coca-Cola. Price appears to be stable and centered around the $18.20 level. At first glance, you might assume that therefore we have equal amounts of buyers and sellers. In a sense we do...but with one critical difference:

And what is that "critical difference"? For the answer, we turn back to Econ 101 and what we learned about supply and demand. Recall that when supply is held constant, changes to demand are reflected in a higher or lower price. However, in the case of Comex Digital Silver, the supply is not held constant. Instead and as noted above, the "market-making" Bullion Banks have the nearly unlimited ability to create additional supply of Comex contracts on a daily basis. The chart below again shows the price changes of Comex Digital Silver for last week. However, be sure to note the additional information provided. If increased demand is met with an equal increase in supply, price remains the same.

So we're left with the question: How much higher would price have risen just last week if the supply of contracts had been held constant? Would the chart for Comex Digital Silver look more like the chart of Amazon rather than the chart of Coca-Cola?

(It's important to note, too, that this is where the fraud comes in and this is why we maintain that Comex pricing is a completely illegitimate process for discovering the price of physical silver (or gold). The sellers of the new contracts (The Banks) are "selling" silver that they don't have and making a promise to deliver metal to a buyer (the Speculator) who has no intention of taking physical delivery. So what we have here is simply have a parlor game and a battle of liquidity where the winner is determined by who has deeper pockets and is thus capable of withstanding price fluctuations and margin calls.)

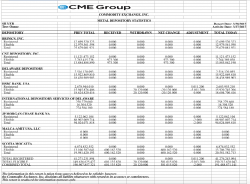

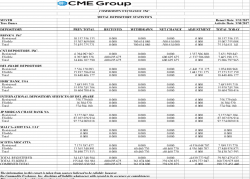

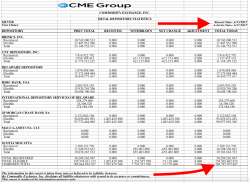

In creating and selling to Specs those 23,713 contracts last week, The Banks essentially minted new obligations to deliver 118,565,000 ounces of silver to the Spec buyers of these contracts. That's about 14% of the silver that the entire world will produce in 2017. Was any silver placed on deposit with the exchange as collateral for these new obligations or did The Banks simply create them from whole cloth through cash and leverage? Below are the CME Silver Stocks reports from Monday and Friday of last week. Note that the amount of silver held in the vaults actually declined over the week from 191.5MM ounces to 190.2MM ounces.

It's at about this point in the conversation where The Cartel Shills and Apologists jump in and claim that all of this new open interest is only being provided by benevolent and altruistic Bullion Banks, which simply provide necessary hedging services for their mining company customers. The Banks make no directional bets: https://www.benzinga.com/media/cnbc/12/04/2478161/jp-morgan-commodities-...

But there are a few, common sense holes in this defense theory:

- The total size of the silver producer hedge book is historically low, as you'd expect with prices barely above the all-in, break even cost of production for most miners.

- And we're supposed to believe that, en masse, the global silver producers combined to hedge 14% of global mine supply in just the past five days?

- And what about gold? With the April17 contract coming off the board last week, total open interest in Comex Digital Gold fell by nearly 10% or 45,471 contracts and is back near 2017 lows. Are we supposed to believe that ONLY silver miners are now actively hedging and selling forward their future production?

Obviously, this idea that The Banks simply "make markets" and "perform services" for their clients is utterly bunk and requires no additional discussion.

What does require one final bit of discussion is the notion of price change over time. While a handful of fundamental factors do play a small role in determining price over time, the notion that physical supply and demand somehow effect price change on an intraday or daily basis is simply outdated and naive. Two great articles were recently posted which detail how it's the paper derivative markets which set price in the 21st century and not the physical markets. Though both articles deal with gold, the same notions apply to silver and, in fact, the leverage in the supply of silver derivatives exceeds gold, making the situation even worse.

- https://www.bullionstar.com/blogs/bullionstar/what-sets-the-gold-price-i...

- https://srsroccoreport.com/record-10-trillion-paper-gold-trading-market-...

Turning back to Econ 101 allows us an explanation of how price is managed lower over time through the limitless creation (supply) of these paper derivative contracts.

Let's pick some random dates back in the spring of 2011. Back then, price was screaming higher as demand for the Comex silver derivative was soaring. What was the total open interest of Comex silver in that period? See below:

January 18, 2011 ---- Total Comex Silver open interest 135,675 contracts

February 22, 2011 --- 145,070 contracts

March 15, 2011 ---134,914 contracts

April 26, 2011 --- 143,341 contracts

You may recall that, over the same time period, the price of Comex Digital Silver rose from $28 to $48. And note that the supply of the Comex derivative contract was mostly constant. Again, see this chart:

Let's compare this to the available supply of Comex silver derivatives in 2017. With a total open interest of 216,372 contracts, you're supposed to believe that this supply increase of over 50% is somehow related to increased hedging by mining companies and others who wish to sell forward their future production. Really? A more logical explanation is that manipulative Bullion Banks are greatly increasing the amount of derivative supply in an effort to contain price at these lower levels. How does that work? One more chart from Econ 101. As you can see, if you can increase supply faster than the increase in demand, price falls. And again, where are we in 2017? The paper derivative price is down 60% from the 2011 highs while supply of the derivative is up 50% over the same time period.

So finally, the conclusions that you should draw from all of this:

- Obviously, The Banks are still active in managing price through the issuance of paper metal contracts. They sell these obligations to speculators in enough supply as to dampen the upward price pressure that would have resulted from supply being held constant.

- Contrary to popular belief, it is most definitely not the supply and demand of physical metals which determines "price". Instead, the trading and daily supply/demand of the paper derivative contract is what determines the physical price. The physical market is then contorted by The Bullion Banks, which manage the wholesale flow of physical metal in order to legitimize this digitally-derived price.

- It's not impossible for the paper price to rise...it's just that certain conditions must be met. Either of two things must happen: a) Speculator demand for the paper derivative must exceed The Banks willingness/ability to supply new derivative contracts OR b) Banks must be forced to maintain a limited supply of paper contracts in the market. Perhaps the ability of The Banks to create new contracts must be tethered to a proven and readily-available amount of silver on deposit at the exchange?

I hope this helps you to understand the forces that are aligned against you as a silver investor. However, do not despair. No fraud can last indefinitely and no institution built upon a foundation of lies and deceit can stand the test of time. Instead, the day is coming where true physical price discovery will again prevail in the precious metals. What will that price be? I have no idea but I'm quite certain that it won't be $125o/oz for gold and/or $18.25/oz for silver. Therefore and as always...

Prepare accordingly,

TF

www.tfmetalsreport.com/subscribe

----------------------------------------------------------------------------------------------------------------------------------------------------

April 17, 2017 update:

As of last Thursday, total Comex silver open interest has now risen to a new alltime high of 227,498 contracts. This exceeds the previous alltime high of 224,540 seen on August 2 of last year and, as a reference, this is fully 50% higher than the common open interest totals back during the fun years of 2010 and 2011.

Additionally, At 227,948 contracts, total Comex silver OI represents 1,139,740,000 ounces of virtual "silver". The ENTIRE world only produces about 880,000,000 ounces per year so total Comex OI now represents 129% of global mine supply.

As you can see, over the course of April, no additional silver has been placed into the Comex vaults as collateral for the new Bank or "commercial" shorts that have been created. Instead, this is nothing but a hyper-leveraged game of "chicken" where The Banks feel confident that their unlimited liquidity can outlast the Specs taking the other side of the trade.

And here's your updated price with OI chart. As you can see, over the past month, the commercials (Comex "Bullion" Banks) have created 38,392 new Comex silver contracts. Therefore, by increasing the total supply of derivative contracts by over 20%, The Banks have managed to contain the total price rise in Comex Digital silver to just 9.5%.

It should also be noted that this increase of 38,392 contracts represents the creation of 191,960,000 ounces of virtual/digital silver. Again, The Shills and Apologists will claim that "this is simply producer hedging" or that all is fine because "there's a levered long for every levered short". But how is any of this relatable to the physical price of silver when derivatives representing 20% of total annual mine supply can simply be conjured up from thin air and supplied to money managers and traders as "exposure". Trading in these derivative contracts are no more related to physical silver than is trading of sunflower seeds or baseball cards.

This is nonsense. It's fraudulent in nature which makes it criminal activity. And it's a pricing scheme that simply must end.

TF