Back in April, the Cartel Shills and Apologists attempted to minimize the news that a settlement had been reached regarding a "nuisance lawsuit" alleging price rigging in gold and silver. As we told you at the time and on many occasions since, this case is instead quite significant and very important. The latest update on the case, released late yesterday, sheds more light upon what we've always known was taking place behind the scenes in the "free and fair precious metals markets".

First, just another reminder of the two key points:

- Because of Deutschebank's settlement offer and willingness to turn "state's evidence" in the case, for the very first time a civil lawsuit regarding gold and/or silver price manipulation is being allowed to move forward into the legal discovery phase. This means depositions, affidavits and subpoenas. Never before has a case been allowed into this phase as all previous civil suits were thrown out by Bank-favored judges before discovery could begin.

- With Deutschebank now having agreed to nearly $100MM in settlements in the case, there is now the proverbial "blood in the water" for every class action attorney in the world. This current laswuit is just one case and this Deutschebank settlement is just one small part of it. There will now be countless new lawsuits filed, each of them seeking damages from The Bullion Banks for the now-discovered and proven collusion and manipulation of precious metals prices. Potential claimants range from mining companies to shareholders to day traders to investors/stackers.

So, what did we learn today. Here are two links...one from Reuters and the other is a more detailed analysis from ZeroHedge. We strongy urge you to read both.

- https://www.reuters.com/article/us-silver-lawsuit-idUSKBN13X1QZ

- https://www.zerohedge.com/news/2016-12-08/deutsche-bank-provides-smoking...

And here are the amended full filings from the case:

Silver Rigging 1 by zerohedge on Scribd

Silver Rigging 2 by zerohedge on Scribd

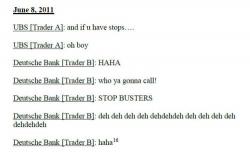

From the ZeroHedge article, here are two text exchanges that have been unearthed and submitted only because of the Deutschebank cooperation and legal discovery. There will be many, many more. Of that you can be certain. (click to enlarge)

As an aside, note the date of the exchanges posted above....May and June of 2011. After reviewing this evidence of direct collusion between The Bullion Banks, do you have any remaining doubt as to the origin of the trades in the May Day Massacre of Sunday, May 1, 2011? That sudden $6 drop in silver brought an abrupt end to the Cartel short squeeze that had pushed silver from $38 to $48 in April of that year. What followed were five CME margin hikes in nine days and silver falling to $38 in days and $26 within weeks. Again, after reading the text messages above, you now know precisely how this was accomplished.

Additionally and on a personal level, you now have confirmation of why TFMR exists in the first place. We gained notoriety in 2010 because we were able to offer precise guidance on price due to recoginition that Cartel traders were colluding to move price, run stops and paint charts. Because we could predict in advance where these traders would act, TFMR rapidly grew and ultimately became what it is today. Though we've since shifted our focus to broader topics, rooting out and exposing The Bullion Bank Cartel remains our focus. Bringing about an end to the manipulation and the Bullion Bank Paper Derivative Pricing Scheme will always be our ultimate goal.

But this is far from over. If we know anything about the legal process it's that it takes time and there are always delays, filings, briefs etc. Therefore, do not expect an abrupt end to the Bullion Bank price manipulation in the next few weeks. Instead, recognize these key takeaways:

- The potential monetary liabilities alone will now force many smaller players in bullion banking to exit the sector. Even some of the larger Banks, sensing the declining profits and increasing liabilities will close up shop.

- The mining companies and their executives, now finally faced with the truth about their alleged allies The Bullion Banks, will soon begin shifting their hedging and financing activities away from The Billion Banks and the LBMA.

- Points number 1 and 2 will lead to an ever-decreasing market share and dominance of fraudulent LBMA and Comex system.

- As the Paper Derivative Pricing Scheme loses influence and importance, a shift toward true physical price discovery will move to the forefront.

What does this mean to you?

Since you now know with certainty that the "price" derived through the digital exchange of paper derivatives is false and manipulated, you MUST use this knowledge to your advantage. Remember, physical gold and silver are priced as if they are abundant when they are not. What IS abundant is the paper dervivative that is used to set the price. As derivative trading fades away, physical trading and pricing will take over. And the price discovered in a truly physical market will most assuredly NOT be $1200 or $17 per ounce.

Have a great day, confident in knowing that you have been proven correct and that you are winning.

TF