Recently, we've written quite often of the surge in Comex gold open interest and the attempts by The Banks to manage the paper derivative price by increasing the paper derivative supply. In this post, we turn to Comex silver, where The Banks are pulling the same tricks but with a very interesting twist.

Again, if you haven't been following the increases in Comex gold open interest and how The Banks use fresh derivative supply to dampen the paper price, please check our most recent update here: https://www.tfmetalsreport.com/blog/7700/onward-toward-bullion-bank-coll...

But let's take this analysis in a different direction today. As we've meticulously noted, the price of gold is now up over $300 in 2016, from $1060 to today's $1370, for a total gain of 29.2%. Over this same time period, the total amount of contracts floating on the Comex has also increased from 415,220 on 12/31/15 to yesterday's 652,971. That's an increase of 201,751 contracts or 48.6%. Looked at another way...Since every Comex contract represents an obligation for 100 ounces of gold, the total supply of "paper gold" has increased by 20,175,100 troy ounces or about 627 metric tones.

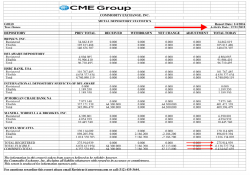

So, over the same time period, have we seen any change to the total amount of gold allegedly held within the vaults of the eight Comes repositories? As a matter of fact we have! As you can see below, the total amount of Comex vaulted gold on 12/31/15 was 6,414,643 troy ounces, with 276,000 in the registered category and the rest listed as eligible (click to enlarge):

And now look at the most recent report from yesterday:

Well, how about that? Over the same time period, the amount of gold allegedly vaulted on the Comex has increased by over 3,000,000 ounces and, internally, the total registered stock has increased by more than 1,100,000 ounces. Now before anyone claims that this demonstrates the legitimacy of the Comex and The Paper Derivative Pricing Scheme, be sure to note that total paper claims increased by over 20,000,000 ounces over the same time period. So, in the most crude of calculations, we can say that The Banks took the newly-vaulted gold, levered it over six times and then flooded it into the "market" as a way to control the ascent of price.

But let's not stop there because that's not the focus of this post. Before the Cartel/System Apologists and Shills take the information above and claim that all is well and that the Comex is working as it should, perhaps they should look at the same numbers in Comex silver.

Back on December 31, 2015, Comex silver closed at .80. As I type, I have a last of .10. This is a gain of .30 or about 46%. Over the same time period, The Banks that "make markets" on the silver Comex have increased total open interest from 168,153 contracts to yesterday's 211,347. That's an increase of 43,194 contracts or 26%. And again, stated another way, at 5000 ounces per contract, this represents about 216,000,000 ounces of additional paper silver.

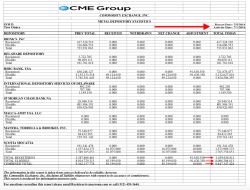

So, have we also seen an increase in the total amount of silver vaulted in the eight Comex silver repositories? Well, let's check. Below is the report from December 31, 2015. Note that the vaults hold a total of 160,671,058 ounces of silver, of which a little over 25% or 40,000,000 ounces is in the registered category:

And now here's your report from yesterday:

So, the paper price of silver has risen by 46% WHILE the amount of available paper silver derivatives has increased by 26%. At the same time, the total amount of silver held within the Comex vaults has decreased by 5.6%. Perhaps even more interesting, while price has risen 46%, the total amount of registered Comex silver has decreased by 15,638,897 ounces or 39%.

Let's sum it up this way:

COMEX GOLD: Price up 29%. Total open interest up 48.6%. Total vaulted gold up over 3,000,000 ounces or 47%.

COMEX SILVER: Price up 46%. Total open interest up 26%. Total vaulted silver DOWN nearly 9,000,000 ounces or 5.6%.

And let's consider one more thing...

With total open interest of 652,971 contracts, the Comex currently has paper obligations for 65,297,100 troy ounces or 2,031 metric tonnes of gold. Total annual mine supply is around 3,000 metric tonnes so total Comex paper derivative supply equals about 66% of total mine supply.

However, with total open interest of 211,247 contracts, the Comex currently has paper obligations for 1,056,235,000 ounces of silver. Total annual mine supply is around 880,000,000 million ounces so total Comex paper derivative supply equals about 120% of total mine supply.

Putting it all together...

While it's clear that The Banks on The Comex are desperately feeding new paper contracts to The Specs in an effort to contain/restrain the gold price, at least there has been a coincident rise in the physical collateral backing the paper contracts. In silver, where the situation is equally tenuous, The Banks are issuing new paper contracts without conjuring up any additional physical collateral. The Banks are simply adding additional leverage to an already-teetering system and, in doing so, have extended their potential delivery liability to 120% of total global mine supply. (Actually, if you take out China's 150,000,000 ounces of annual production that's NOT for sale, total global silver production falls to 730,000,000 ounces and the liability rises to 145%!)

In 2011, the Comex price of silver shot higher due, in large part, to physical demand. This run culminated in a $10 move during the month of April that was almost entirely driven by near-panic short covering by The Comex Banks. The CFTC-generated data at the time left zero doubt regarding this conclusion. Only The Sunday Night Massacre of May 1, 2011 and the CME's five margin hikes in the nine days that followed saved The Banks from massive further losses and possible collapse.

Could silver be on the verge of another, similar event? Only time will tell and global physical demand will be the key. However, silver investors would be wise to consider the possibilities and act accordingly, knowing full well the extent of the fraud and scam of the current Comex Paper Derivative Pricing Scheme.

TF