No, not in gold or silver, of course. Nope, today saw a new high in the LSHI!

Of course, longtime Turdites know what the LSHI is but, if you need a refresher, you can find the definition on the Turdisms page. https://www.tfmetalsreport.com/glossary

Oh boy that was fun. Joe Kernen throws it to "Hampton Pearson at the Labor Department" and ole Hampton proceeds to drop a bomb on the Fort Lee crowd that left them speechless. He might as well have blasted some 14-megaton flatulence the way the room went silent in shock! The Shill looked like a deer in the headlights. Austen Goonsby went into SPIN overdrive and, of course, LIESman began to sweat profusely.

What does it all mean? The U.S. economy sucks and it ain't getting any better. Period. End of story.

And please, please, please...DO NOT BUY THIS GARBAGE ABOUT QE∞ ENDING. It can't and it won't.

And recall....and I say this with 100% certainty because I heard it with my own two ears...The Bernank said that:

- He might look at "slowing the asset purchases" when unemployment falls to 6.5%.

- He doesn't expect 6.5% unemployment until mid-2015, at the earliest.

And, regardless, it doesn't matter. QE∞ isn't about growth or jobs or anything economic. It's about providing a constant bid in the bond market so that rates stay at 2% or lower. Again...Period. End of story.

I could go into the specifics of the lousy data but why? You've probably read about it elsewhere and if you haven't, I can just give you this link. It pretty much tells you all you need to know: https://www.zerohedge.com/news/2013-04-05/people-not-labor-force-soar-663000-90-million-labor-force-participation-rate-1979-le

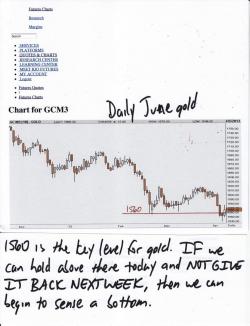

So let's turn the discussion back to gold and silver. That they haven't exploded higher today is due to several factors, one that I'll show you below. Primarily, though, sentiment is lousy and momentum is all to the short side. Therefore, it's very difficult to turn things around in one day. IT WILL TURN. AND SOON. But it's always going to be unlikely that such a major shift can occur in one day. So, we wait. And we continue to buy at these deeply-discounted prices. And we add to our stacks.

Now check this out. This is outrageous! When the headlines hit at 8:30 EDT, gold prices immediately jumped as new orders hit and a few buy-stops were triggered. Then, while we were still between 8:30 and 8:31, gold sharply reversed and fell back by $14! There is only one way for this to have happened so quickly: A huge sell order was placed above the market BEFORE the news with the intent of capping any surprise rally and blunting the momentum. If you ever wanted direct evidence that the metals are manipulated and managed, there you have it. And sadly, it worked. Halting the rally at 1575 emboldened the shorts to drive it back down and now, as I type, gold is still just $1565 and silver is up a measly 19¢ and barely over $27.

So, here we sit. The metals should be screaming higher but there not. So what else is new? They should have been screaming higher since October. And though we've bounced a bit today, we are clearly still not out of the woods for a drop below $1525 and $26. Today's action helps and I suppose that The Washout is slightly less likely today than it was yesterday. But we must remain guarded and on the lookout.

The first thing gold needs to do is to hold these gains and close today back above $1560. It then needs to stay above $1560 next week. Still, though, it would be foolish to "call a bottom" before gold gets back above $1625. Silver, too. As you can see on the chart below, every time this year it has had a chance to form a bottom, it has failed. Now our first target is $28. Don't even think about getting excited/optimistic until that level is regained and, frankly, don't get confident that a bottom is in until price is back above $29.40. That's a long way from $27.

Anyway, the moral of the story remains the same: Just stay patient and keep adding to your stack. You are on the right side of this. The end of the Great Keynesian Experiment continues to unfold right before our eyes. Do not lose courage or be swayed by the day-to-day machinations of the Cartel-controlled "markets". They don't matter. All that matters is that you continue to add to your financial protection by the accumulation of physical precious metal. One more time...Period. End of story.

TF