We're holding support and bouncing on a Happy Tuesday. I hope you're ready to buy the dip!

Again, as discussed yesterday, I should have seen this mini-correction coming. As a recognizer of patterns, I should have anticipated that the market action post-QE∞ would resemble the market action post-QE2. I mean, why wouldn't it? The metals are still manipulated by the same scoundrels that were in charge back in late 2010 and they are still being controlled within their "managed ascent".

Recall that gold rallied from 1320 to 1430 in the weeks following QE2. Then, in early January, Cartel capping caused momentum to fail and price began to pull back. Over three excruciating weeks, price was pressed lower, all the way to...wait for it...1320. In fact, at the bottom, it actually touched 1308. From there, it went on a 7-month tear courtesy of sloshing liquidity and a downgrade of the U.S by Standard & Poor's, finally reaching 1920 in late August of 2011. That's a gain of nearly 50%!

Silver performed almost identically. After peaking in early January 2011 at 31.20, it fell over the next three weeks to a low of 26.50. Again, where was silver trading during the week prior to the formal announcement of QE2? Near 26.50. Like gold, once the gains post-QE2 were erased and clawed back, silver went crazy and rose all the way to $49 in just 90 days. That, my friends, is over 80%!

Once this mini-correction runs its course, are the metals set up for similar gains? It's possible, perhaps even likely. Maybe even probable. Many of the same conditions that prevailed in 2011 will exist again in 2013.

- The Fed, currently executing $40B/month in non-sterilized QE, will almost certainly increase that number toward $85B/month once Operation Twist ends later this year. Remember that QE2 was nearly the same amount at just under $100B/month.

- The U.S. government again stands at the edge of a fiscal cliff with "Taxmageddon" coming in 1/1/13 and another debate to raise the debt ceiling just around the corner. Could more U.S. debt downgrades be on the way soon, too?

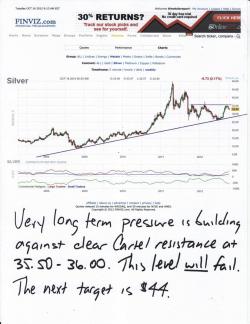

- And don't ignore the ongoing significance of this chart:

Anyway, at this point, it's reasonable to assume that, once this correction is finished, the metals will surge dramatically higher. Prices will finally eclipse the Cartel-enforced caps at $1800 and $36. I fully expect new alltime highs in gold by early 2013 and, shortly thereafter, a move through the $2000 level. In silver, JPM resistance at $36 will also fail in the days ahead and silver will begin a charge toward $44. Above there, the old alltime highs near $50 await.

(Just for fun, let's say that things get "disorderly" for the Cartels again and prices rise in 2013 at the same clip that they did in 2011. This would put gold near $2500 and silver would approach $60.)

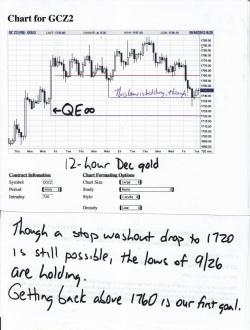

So, given that the long-term picture is extraordinarily bullish, what are you waiting for? Buy the dip!! Of course, if you're like me, you may be trying to wait for the absolute bottom so that you can feel real smart. This is a pretty stupid strategy but I do it for fun and because my ego gets in the way. Regardless, I think that so far today we are seeing some short-covering related to CoT-painting by The Cartels and I expect another run at breaking price lower either tomorrow or Thursday. We may see new lows for the week but we might also not see them. Let's just see. Since I haven't sold any of my December calls, I'm still positioned to participate in the rebound, Right now, I'm just simply looking to add. I may even move out to March, just to give myself more time. I'll keep you posted and update you if and when I decide to move.

For now, here's what I'm looking at. Gold has retraced it's gains post-QE∞ and has found support right where I'd expect near the lows of late September. This is a very good sign. Another good sign is the complete washout of momentum as indicated by the RSI. Note that this index is now at levels not seen since last summer!

Silver, too, has retraced its gains from mid-September and is poised to resume its rally. A source in London has informed me that The Cartel is very reluctant to fill some very large orders for physical that currently reside near $32.50. IF this is the case, it is unlikely that paper silver will fall much below there. (Note that the low yesterday was $32.57.) There is still the possibility, though, that the momo-junkies and smaller commercials will attempt to jam price lower again but significant chart support lies between 32 and 32.50 and well as the 50-day moving average.

Just a couple of other things. Yesterday I posted this link ( https://tfmetalsreport.blogspot.com/2011/01/1600-gold-by-june-10-2011.html) It's fun to go back and review this post for a number of reason but I want to highlight something. Read this:

"Speaking of the dollar, lets start there. It looks terrible. What will TPTB come up with this time to rescue it from 78.47 on the March contract? Who knows but it looks more and more like 77-77.50 is coming very soon."

Again, that was typed on 1/21/11 when gold was near $1320. This points out the fallacy and deliberate deception of "The Dollar Index". This index is often cited as a measurement of strength or weakness of the dollar. Again, though, it only measures the dollar against other fiat currency. Over the past 22 months, the index leaves the uninitiated with the impression that the dollar has been stable. We know, however, that it is only "stable" against other, similarly-worthless fiat. Against gold, it has devalued by more than one third!! Do you ever hear that reported on CNBS or in the MSM?? Heck, no! To do so would expose the lies and theft of expansive monetary policy, fractional reserve banking and Keynesianism.

Which leads us to your reading assignment today. Actually, I posted this into the comments of yesterday's thread so, if you've already read it, just move on. Everyone else should take 5-10 minutes to read it. Lew Lehrman has long been a champion of sound money and, in this piece, he lays out a simple and easily-understood rationale for a return to a global, gold-backed monetary system. (Again, my feeling is that this is going to happen and it won't be a voluntary decision for The West.) If you've ever wondered how and why a gold standard could be re-implemented, please take the time to read this article.

https://spectator.org/archives/2012/09/14/a-road-to-prosperity/

OK, that's it for now. I've been working on this for a couple of hours and, as I close, I see that prices have rebounded some but have not yet crossed back above the important levels drawn on the charts above. Therefore, be on the lookout for some more weakness and another attempt to break price lower after the close today and into tomorrow and Thursday. Do not despair, however, my friend. Time and fundamentals are on our side and we shall be victorious and vindicated. Soon.

TF