Many have said (and continue to say) this about me. In this case, however, I intend it for the silver market where seemingly no one is left. Besides, more appropriate cliches for yours truly are obviously:

- Doesn't have both oars in the water

- A few sandwiches short of a picnic

- A couple aces short of a full deck

- Not the brightest bulb on the tree

Look, I know it's frustrating to wait for silver to turn and rally. It's driving me crazy, too. Even though I'm on record predicting an exciting and explosive summer for silver, it looks like we're going to have to remain patient. Why? It's all in the open interest.

Back on Friday, as gold was rallying almost $60, silver managed to eke out a gain of just 75c. Then today, it turned around and gave back 2/3 of it. Blechkkk. And why is this? Because the lights are on and nobody's home.

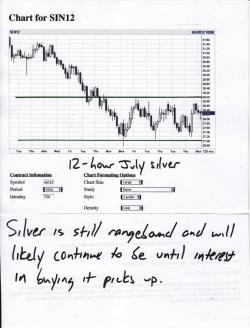

Last Thursday, silver fell 23c and open interest jumped by 2,000 contracts. On Friday, silver surged 75c and OI dropped by 2,000 contracts. What's the deal? I would imaging that today's numbers, when we get them tomorrow, will show OI returning. Why? Because silver is simply getting jerked around here by The EE. They let silver fall in order to suck in some WOPR/algo shorts and then they let silver rise to force those same shorts to cover. Back and forth. Wash and repeat. Until/unless real money returns to the silver pit, it's going to be very hard to break this cycle. Either that or a breakout above $30, which would be needed to entice some spec long buying. Until then, silver will just keep churning away in this current $27-29 range.

One thing of note, however. The internals of the silver open interest are interesting. The OI rise on Thursday came almost entirely in the Sept12 contract as it went from 11,310 to 13,394. On Friday, it was flat at 13,428. In the July12 contract, Thursday was flat and Friday saw a drop of 2,300. Hmmmm. Not sure what to make of that.

Anyway, here's a 12-hour silver chart. You can clearly see the current range. <Yawn>

Gold, on the other hand, looks almost entirely different. Back on Thursday, when price fell a little over $1, total OI contracted a bit but the front-month, Aug12 contract OI was virtually unchanged. Then, on Friday when gold rallied $58, total OI surged by 12,000 contracts with the Aug12 surging by nearly 14,000. Here we have a somewhat "normal" market. Open interest and price both rising by over 3%. Together. In tandem. What a concept! Gold undoubtedly saw a little profit-taking today so I would expect OI to contract a bit when we get the numbers tomorrow.

As for price, the second consecutive close above $1610 should confirm the breakout of the range but that doesn't preclude a brief drop back toward 1600 or even 1590. Regardless, the quintuple bottom near 1525 is definitely now the floor and I think that gold will continue to trade higher here. It won't be easy, though, so don't expect another $60 day anytime soon. For now, 1630 will be resistance. Actually, the entire area between 1630 and 1650 looks like tough sledding so I would imagine that we'll slog along a bit here.

Additionally, with London closed again tomorrow, expect more volatility. Without an AM or PM fix to be worried about, The Cartel can literally bang price any way they wish. Since they likely added longs on Friday, they may want to sell some before the survey tomorrow in order to "paint" it a little. We'll see. Regardless, I for one am looking forward to Wednesday in order to see how physical demand looks after the 4-day respite.

Just one other thing today. One of your fellow Turdites created a new video game that pits both classes of Republocrats against each other. You should check it out. I know he's looking for feedback.

https://www.kickstarter.com/projects/1493481645/democrats-vs-republicans?ref=recently_launched

OK, that's all for now. Sorry for the late post today but I wanted to watch all of the action before writing. As I close, I see that the metals have rallied a bit on the Globex and this is encouraging. Let's just hope we can get through tomorrow without too much damage. TF

p.s. Anyone still wondering IF there will soon be a gold-backed global settlement currency would be wise to read this: https://www.zerohedge.com/news/hoarding-continues-china-purchases-record-100-tons-gold-april-hong-kong. It's only a matter of time.