Of course I'm not going to suggest that you attempt to catch the falling knife, however, those still trading may soon see an opportunity to buy.

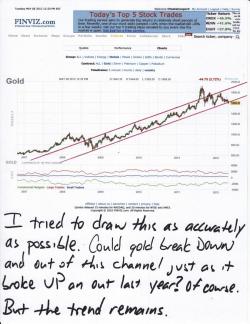

First, let's look at the long-term chart we've been following for years. Is it possible for price to break DOWN and out of the channel? Of course it is, I just didn't think it would. But, similar to the break UP and out following the S&P downgrade of the U.S. last August, gold can break DOWN yet the overall trend remains in this "managed ascent".

Just for kicks, here is today's 5-minute chart. Roughly 6000 contracts dumped at the Comex open started the whitewash and has left gold clinging to support at the round number of 1600.

As we hold all core positions and use any and all bouts of weakness to add to physical stacks, where might there be a trade? Well, let's look closely at two longer-term charts. First, this daily chart. Note that gold remains in the same, old, $80-range down channel but also note the reflexive short-covering that has occurred on previous drops to the lower extreme of the channel.

And $1575 also looks like the beginning of support in this weekly chart, too. NOT saying that gold can't continue lower, through 1575, as it certainly can. However, anything between 1525 and 1575 sure looks like an attractive entry point for a possible trade.

Lastly, from a LONG TERM perspective, please keep this in mind: On 5/9/11 (May 8 was a Sunday), gold closed at $1503. This equates to a year-over-year return of nearly +7%. For perspective, the S&P 500 ended 5/9/11 at 1346. This equates to a year-over-year return of less than 1%. Stitch that into your clothes, Charlie, you FOAD!

Please hang in there and keep the faith. Your gold (and silver) is your only protection. TF