And this matters how? And why, exactly, do you care? Seriously. You need to ask yourself those two questions.

Look, never forget that the point of of this entire endeavor is "preparation for the end of the Great Keynesian Experiment". Part of that preparation is the accumulation of physical precious metal. Gold to protect your worth and wealth. Silver to protect you ability to acquire everyday necessities.

Do you believe that the current global financial system is now so malignantly flawed that it will not survive? Do you believe that beacuase the U.S. government is so overwhelmed with debt, current and future, the U.S. dollar is doomed as a global reserve currency? Are you fearful that global governments, in their futile attempts to maintain power will stop at nothing, economically and militarily, to avoid collapse and that these efforts will ultimately lead to war, insurrection, massive price inflation and civil unrest? If you answered "YES" to any of these three questions (and I suppose you did), then you should continue to BUY precious metal. Selling metal and converting it back into fiat is simply out of the question. Most of all:

If you answered "YES" to any or all of the questions above, why in the world do you care right now if gold is $1610 and silver is $29.50?

I ask this with all sincerity. Again...why do you care? You should be rejoicing at the opportunity to add metal at these prices. Last spring, it took nearly $5000 to buy just 100 ounces of silver. Today, that same $5000 will buy you 170 ounces. Hooray! How fortunate are we?!? The absolute sham of the current Comex/LBMA system has allowed everyone this extra time to buy/add metal. Please don't waste this opportunity! Also, please take delivery and store your metal somewhere safe.

Please indulge me to state this as clearly and unequivocally as possible:

DO NOT CONVERT YOUR METAL BACK INTO FIAT CURRENCY. BY DOING SO, YOU WILL SACRIFICE THE ONLY FINANCIAL INSURANCE AND PROTECTION YOU HAVE AGAINST THE COMING COLLAPSE. CONTINUE TO USE THIS AND ALL FUTURE PERIODS OF PAPER PRICE WEAKNESS TO PURCHASE ADDITIONAL METAL AND TAKE DELIVERY.

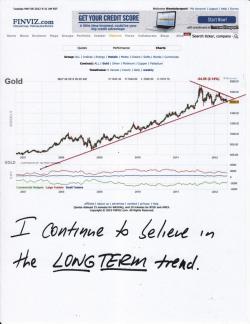

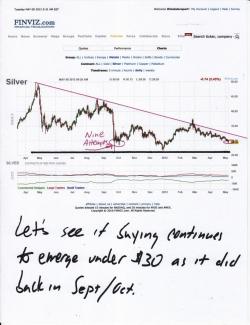

I provide technical analysis of the gold and silver markets solely to draw attention and readers to this site so that I might warn as many as possible. I will continue to do so, regardless of the criticism of TA in general. Though the current precious metals markets seem to have been fundamentally changed by the MFGlobal disaster, underlying demand for physical metal will continue to make TA a useful tool. To that end, I present today these two charts only. In gold, the long-term trend is still intact and, as you know, I'm a big believer in the long-term trend. In silver, you can plainly see that the "right shoulder" is being carved in a pattern similar to the "left shoulder" last fall.

Now, before you leave my site today, I want you to read this extremely important piece of analysis and then come back:

https://www.alt-market.com/articles/765-economic-alert-if-youre-not-worried-yetyou-should-be

You should also read the latest from Jim Quinn:

https://www.theburningplatform.com/?p=33800

And this nugget from Mike Krieger:

https://libertyblitzkrieg.com/2012/05/07/watch-bill-gates-stutter-like-a-moron-on-gold/

I'm going to stop here. After being out all day yesterday, much stuff has piled up on my desk and demands my immediate attention. I'm sure I'll be adding thoughts to the comments all day so please be sure to check them from time to time. Hang in there. Keep the faith and go add to your stack. TF