As Barney Fife would say: "Boyohboyohboyohboyohboyohboyohboyohboy". Do we ever have a humdinger of a week ahead of us. So, to get our heads screwed on straight and prepare, I thought it best to roll out a little Sunday afternoon warm up.

First things first. Since December, many have commented and emailed looking for me to call another "Turd's Bottom". In a way, I did. After the breakdown last September, I kept trying to warn everyone that gold and silver could fall all of the way to their long-term trendlines, projected to be near 1550 and 25. As we now know, they came pretty close. Gold got to about 1535 in the last week of December, silver reached down and double-tapped 26 and that was that. I could have rolled out another grandiose bottom call but I chose, instead, to use it as a teaching moment. Judging by the emails I received, only a few of you seemed to notice what I was doing. To recap, here is the path upon which I was trying to lead you:

https://www.tfmetalsreport.com/blog/3211/revise-and-extend

https://www.tfmetalsreport.com/blog/3218/how-bout-some-charts

https://www.tfmetalsreport.com/blog/3240/study-open-interest

https://www.tfmetalsreport.com/blog/3246/other-technical-indicators

https://www.tfmetalsreport.com/blog/3249/breakout-coming-important-24-ho...

https://www.tfmetalsreport.com/blog/3254/proceeding-planned

Anyway, the point is, I've been trying to provide you with the tools to pick your own bottom. (That sounds nasty.) Next time...and, believe me, there will always be a next time...you won't need me or anyone else to tell you. Perhaps you'll be able to figure it out for yourself.

And the bottom is in. I don't give a damn what some $75/month paid subscription guy says. For that matter, I don't care what Jim Rogers says, either. Anyone waiting or hoping for gold to trade down to 1500 or 1200 is crazy. And silver definitely is not trading back to the single digits. What kind of fool believed that shit anyway? When did the fundos change? Did I miss something? Was the U.S. suddenly on a path toward fiscal sanity? Of course not. Markets "correct". It happens all the time. In the precious metals, this latest correction was particularly nasty because the rallies that preceded the correction scared the bejeezus out of the bullion banks. Now that they have lightened a substantial part of their long-standing short positions, the PMs are once again trading higher.

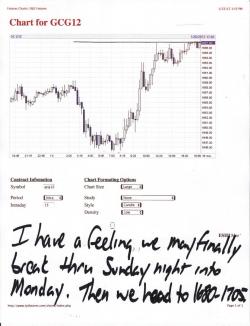

In the short term, where do we go from here? Well, first, take a look at these 15-minute charts from Friday:

The metals don't resume trading for another 2 hours but, based on these charts, I expect them to trade higher overnight and into tomorrow. Gold should finally break through 1665 and silver will begin a move toward 33. I expect things to grind to a halt there, though, particularly in silver. Longtime Turdites will recall that the $33 level in silver is a very significant number. It was the bottom back in May and silver has oscillated around 33 many times in the past 8 months. It will likely do so again. Look for the EE to retreat early but then mount some defense at or near $33. Whether or not it charges right through that level will go a long way toward answering the primary question regarding the explosive move back on Friday. Namely, was the huge rally caused by excitement over the expansion of PSLV and maybe Sprott himself (which nearly everyone thinks) OR was the rally primarily a massive EE short-covering rally (which I think)? How silver reacts near 33 will help answer the question. A review of the open interest numbers tomorrow will help, too. We'll see.

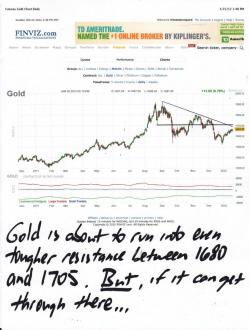

From a longer term perspective, it's now clear that we are in a sort of "Phase Two" area. What I mean by that is:

- The metals have bottomed and the correction is over.

- The metals are now grinding higher in a sort of "no mans land" between the bottom and the real breakout.

- The real breakout will occur when gold trades through 1705 and then 1800. The real breakout in silver begins when it trades through 35 and then breaks the downtrend line from the highs of last April.

Lastly, there will be a lot of talk this week about the potential for QE3. For me, the primary items to watch are the POSX, the 10-year note and the long bond. Recall that we began discussing these last week:

https://www.tfmetalsreport.com/blog/3274/all-about-pig

Remember, overt QE is all about supporting the U.S. treasury market and keeping rates low. Interest rates cannot be allowed to rise for a multitude of reasons. Keep in mind that falling bond prices mean higher interest rates and, like anything else, bond prices fall when sellers outnumber buyers. The Fed, as the buyer of last resort, will restart overt QE to keep bond prices from falling.

First, review again this chart from last week:

Now look at these latest charts from Friday:

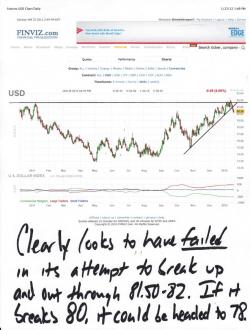

and here's a chart of The Pig, for good measure:

The point is: The bond and Pig charts do not yet signal that QE3 is imminent but it sure looks a lot more likely than it did just one short week ago. As you might imagine, I'm very much looking forward to seeing how these items trade this week. Very interested, indeed.

OK, that's all for now. The markets re-open in just 75 minutes so I think I'll head out to gym in order to blow off some steam and prepare. You should do the same. The next five days are going to be consequential. Get ready.

TF

9:20 am EST UPDATE:

Just a couple of notes as we start the day. First of all, The Pig. After falling precipitously in the overnight, it will likely find support around 80 on the Mar12 (79.75-80 cash). A bounce from there will likely serve to keep some pressure on the metals.

Speaking of pressure, get a load of this garbage! Rarely do you see such dramatic opening ticks as these below. Often, the EE will give the Comex about 10 minutes to suck in a few extra buyers before the Monkeys attack. Not today!

So now the big question is: Will a couple of FUBMs be painted onto these charts as we go through the morning? It's going to be tough to do, especially if I'm right about a short-term bounce in the POSX. Today's action in silver will also go a long ways to helping us determine what caused Friday's big rally. A Sprott-induced rally should have further legs today. A short-covering rally would peak at some pre-determined resistance and then stall and consolidate. We'll see. As you know, my hunch is choice #2 and the silver rally overnight did stop at almost exactly the lows of last May. Some charts show the May lows to be 32.60 but I seem to recall 32.80. Either way, that's exactly where things stopped early this morning. I'll also be patiently awaiting Friday's OI numbers today. If the Friday rally was Sprott-induced, then the total OI should have expanded considerably, something like 4000-5000 contracts. If it was instead the result of some buying and some short-covering, then we'll see a relatively flat OI change of -500 to +1000 contracts. The numbers usually come out around 3:00 EST and I'll be sure to report them in the comments section of this thread.

Here's a little Mark Steyn to help you pass the time:

https://www.nationalreview.com/articles/288778/sinking-west-mark-steyn

Have a great day! TF