As we've gone through this week, I've tried to lead you to this point. We examined open interest and secondary technical indicators. Everything points toward a bottom and a breakout. Now the question is: Will price follow? We will soon know. The next 24-48 hours will tell the tale.

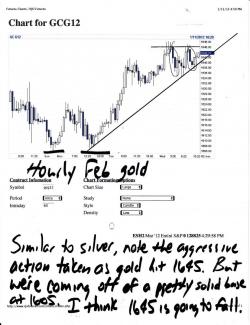

Let's just go straight to the charts. First is gold. I start with gold because, if the breakout occurs, I think that gold will be the driver and that silver will come along for the ride. First of all, here's an 8-hour Feb gold. You can clearly see the significance of the 1645-1650 area. Above there, and it looks like a bottom is in. In fact, it's a double bottom aligned with the panic lows of September. Below 1645 however and you are still rangebound and, of course, the possibility always exists for another test of the lows of the range.

So, if 1645 is so important, we can expect The Cartel to defend it. Are they? You be the judge. (Note the dark blue candles that follow the two encroaches today at 1645.)

I think it's likely that 1645 will fall, though. Go back up and look at the 8-hour chart again. Look at the severity of the attacks I circled. Those are $60 and $30 beatdowns. All we saw today were $10 beatdowns. Throw in the fact that total OI rose yesterday (a $23 up day) by 3000 contracts and it appears that The Cartel is resigned to letting gold move higher. In the end, they don't mind letting 1645 go because the real battle will be near 1700, when gold encounters the down trendline from the highs back in September. If The Cartel lets 1645 go, they'll simply fall back and begin their fortifications and battle plan for "main event", later this month.

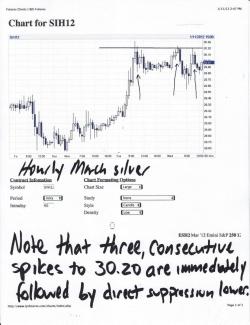

So, here's the big deal. If gold breaks through 1645, you can almost be certain that silver will rally along with it and silver tonight rests at a very important crossroads. First of all, look at how aggressively the EE defended $30.20 today. Note that there three, different attempts to move through that area. Also note that each attempt was met with a big, blue candle in the very next hour. This is direct evidence of EE price capping.

So, why is 30.20 so important, you ask? Well, check out these next two charts and you'll see.

Clearly, silver is at a very important juncture. It will either move higher and through 30 and beyond over the next 24-48 hours or it will fail and be pressed lower, probably leading to a re-test of the $26 area over the next 10 days. What will happen?

Again, I believe that gold is the key. If gold breaks out through 1645 as I expect, it will drag silver with it. The EE will be forced to retreat and a double bottom near $26 will have been set. The EE appears resigned to this fact, too. Note that yesterday, a day when silver was up over $1, the total open interest actually declined by 300 contracts. This tells me that the EE was actively covering shorts yesterday in the rally and the primary reason they would do that is because they fear the breakout that seems to be just over the horizon.

So there you go. Watch things very closely overnight and tomorrow. Gold should be your key. If it can move through 1645-50 overnight tonight, that level should then serve as support for the inevitable raid in London and/or New York tomorrow. If gold then survives and moves on toward 1660 and 1670, it will, of course drag silver along with it and the all-important silver bottom will most likely be in.

I will be watching this all very closely and updating this post overnight and tomorrow. Stay positive and stay tuned.

TF

10:10 am EST UPDATE:

First of all, many have commented that it's nice to see "the old Turd back". Not sure what that means but if it pertains to TA, please understand that the last 100 days or so have not been conducive to trading and forecasting. However, with this breakout, I firmly believe that the uptrends are resuming in both gold and silver. Additionally, these site changes I keep mentioning are designed to almost separate the TA from all the other stuff. Hopefully, the markets will continue to prove me right and you will once again see the incredible value of the forecasting that is supplied here.

Gold and silver broke out right on cue overnight and, after pausing near the Comex open, have moved higher still. This is very encouraging. From here, let's not ask for much. Let's simply hope that the metals hold onto these gains through the Comex pit session and close above those resistance levels we've been watching for so long. Namely, gold needs to hold and close above 1650 and silver closes not just above 30.20 but 30.50, as well.

TF

p.s. Full Disclosure: I couldn't help myself today. As you know, the CME and JPM graciously decided to return about 2/3 of my MFingGlobal cash. Since it does not appear that a Comex failure is imminent, I took $1500 and bought a March $35 silver call this morning. Bad Turd. Playing with the criminals again. But, it is only $1500 so I figured...what the heck? As always, I'll keep you posted in how I do and what I might do next.