As you prepare for what promises to be an eventful week, here are a few things to ponder.

First up, the metals are, quite clearly, still being capped and contained by The Cartel. Though I am still of the mindset that there is an active movement by JPM et al to exit their perennial silver short position, that doesn't mean silver can't go down further before it rockets higher. This week's CoT data actually showed an increase in the commercial short position as well as an increase in the spec longs. This can sometimes be a precursor to a raid so be on the lookout. Additionally, having successfully kept silver below $30 last week, the EE has made the chart look a little precarious. Watch the $28.50 level very closely early this week.

Now take a look at this 5-minute chart of gold and try not to barf. The Cartel has spent considerable energy keeping gold below 1625-30 or, stated differently, below its 200-day moving average. Well, look what happened back on Friday. About an hour after the BLSBS report was released, gold surged almost $5 in one, five-minute period to 1632. What happened next just proves again that The Cartel intervenes nearly every day in an attempt to paint the tape and manipulate the price.

And now, with short-term momentum fading, gold risks a drop back into the 15**s. Without some type of news event to propel it through 1630, it looks to fade here and roll over, possibly all the way back toward 1585, maybe even as low as 1565. If attempting to trade, be cautious. On the bright side, the gold CoT was much more encouraging than silver. The specs and banks added longs while the banks also covered some shorts.

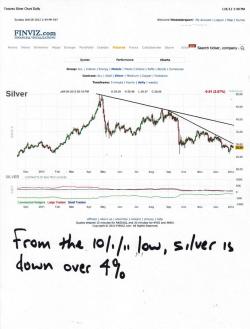

Next up, a whole slew of charts for you to consider. I started printing these because I was looking to compare the relative performance of silver and copper since the 10/1/11 lows. I found it interesting that, in the time since, DrC is up 14% and silver is down about 4%. (Hmmm. Move along please. Nothing to see here.) At any rate, this got me wondering how everything else has fared in the time since the 10/1/11 lows. Well, here you go:

I find it interesting how the charts of crude, copper, stocks, gold and silver all resemble the euro chart until 10/1/11. Then, after that date, crude, copper and stocks de-couple and move higher while the metals have continued flat to lower. Are the metals now perceived simply as an anti-dollar currency and, thus, moving lower because the dollar is rallying? Or...is there something more nefarious at work here?

Here are three links that detail the continuing deterioration of the global, geo-political scene:

https://www.debka.com/article/21629/

https://www.debka.com/article/21630/

Our new friend, Jim Quinn, just released today his forecast for 2012. Definitely worth the read:

https://www.theburningplatform.com/

Lastly, I don't recall where I found this link last week but I thought I'd include it here. It's the original GATA link from March of 2010 that shows the string of emails Andy Maguire sent to the CFTC trying to alert and prove to them that silver was being actively manipulated. Note the pathetic, ambivalent responses from Eliud Ramirez, who was the Senior Investigator of the CFTC Enforcement Division at the time. One would think that the "senior investigator" would have taken a little greater interest in the information that Andy passed along. Guess again...

https://www.gata.org/node/8466

Well, that's all for now. As I close, I see that the EUR has opened to the downside. Let's see if this weakness affects the PM opening, as well, in an hour or so.

https://www.zerohedge.com/news/eurusd-opens-sub-127-and-11-year-low-against-jpy

More Monday. TF