For this month's version of hilarity, CNBS chose to bring back Wyatt Earp. The guy is seriously bad luck for the status quo Keynesians. The last time we saw him, back in December, the BLSBS came in surprising low. We discussed it then on the old blog:

https://tfmetalsreport.blogspot.com/2010/12/bls-bs.html

Today, Wyatt brings with him not just a surprisingly bad BLSBS, he manages to spread his bad luck back into last month's report, too. And it's not just a lousy payroll number of +5000 or +25000, it's ZERO. ZILCH. NADA. Somehow I think ZERO is even worse.

All of the talking heads (with the possible exception of David Byrne) will be spouting the BLSBS number today in their reports. But instead of the same old nonsense that has numbed virtually everyone who happens to be listening, today the only word people will hear is ZERO. Not "the economy gained 22,000 jobs" or "in August, the economy shed 5,000 jobs". No, today the sheep will hear ZERO. "The U.S. economy added ZERO jobs in August." Ouch. Neither The Shill nor The Coug could spin that one positively. The LIESman Shiny Head Index only hovered in the 3-4 range as even The Great LIESman was unable to find anything happy to say.

In the end, this should only serve to reinforce the prevailing opinion here. Namely, QE to infinity. There is no way out. Tax revenues will never, ever catch back up to the funding needs of government on any level be it federal, state or local. Printing and debasing is the only option. Protect yourself and warn others while there is still time.

Onto the charts. For personal reasons, Mister Hyde finds himself sitting mostly in cash. (His "status" will officially change next Friday so I would highly encourage all single lady turdites to send him a private message of congratulations.) Hyde asked me this morning if it was too late to buy. Two things to know:

1) It is never "too late" to buy the precious metals. Prices will be higher next month. They'll be higher by Thanksgiving. They'll be higher still in 2012. Well...you get the picture.

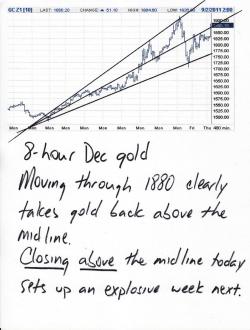

2) By virtue of today's price action, both charts looks extremely bullish. IF gold can close above 1880 or so and silver can close above 42.50, both metals looks poised to have exhilarating weeks next week. Keep in mind that most everyone will be back from "holiday" then, too, and we will see a significant increase in volume and open interest. With OI already so low in both metals, you can safely assume which side of the OI will expand.

Lastly, I mentioned above the idea of "private messaging". I promised you last month that we would add this feature as well as an "ignore user" function. In case you haven't noticed, both options are now available. The Turd listens and acts! Thanks to the Tech Team for implementing these additions and thanks to all who supported last month's Turdathon to raise the necessary funds to help cover the costs. We are still taking improvement suggestions and I hope to have more projects and Turdathons soon. I'll keep you posted.

I have lasts of 1879 and 42.88 so we definitely have a rooting interest in today's action. Have a great day. Have a fun day. Smile and be happy. TF