No catchy title to this update. I just want you to read and ponder this post. Then, plan your trades accordingly.

Let's start with silver where the technical picture is more clear, at least in the traditional sense. Take a look at the chart below:

I've shown this chart several times in the past week so it should look familiar. Something new caught my eye today. Have you seen the new OI numbers? Our friend, "Tesla" has taken it upon himself to update the comments section with the latest numbers each afternoon. (Thanks, Tesla!) Keep in mind that the OI numbers are always basis the close yesterday. So, today's numbers show us the OI from Monday. That said, the number is once again amazingly low at 112,795 contracts. Again, as a reference, the OI in late April was approaching 150,000. Fully 20-25% more! Now stick with me on this. Maybe I should lay this out chronologically to make it easy to follow? OK, here goes:

1) Since silver bottomed around $34 in early July, the channel I've drawn has contained price.

2) Note that on two occasions, 7/13 and 8/19 (points 1 and 2 on the chart), silver decisively broke through the mid-line and proceeded to move sharply toward the top line.

3) Total OI on 7/13 was about 113,000 contracts. By the peak on 8/5, it had risen to about 119,000.

4) Total OI on 8/19 was nearly 116,000 contracts. At least week's peak, it had risen to nearly 122,000.

5) Today's OI is all the way back down below 113,000.

6) Look closely. Price once again sits poised to burst through the mid-line, which is near $42.

Conclusion: Watch price and OI very closely for the next 48 hours. IF silver accelerates through $42 on rising open interest, there is a very high likelihood that it is once again making a move toward the top of the channel. A move that corresponds in magnitude to the previous two would take silver to 45.50-46.00, perhaps as early as next week.

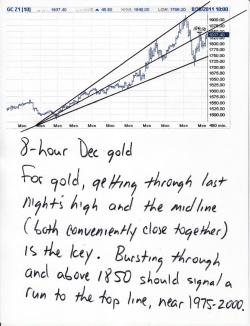

Now let's move on to gold. When I say it's not as "traditional" technically, it's because I'm using this crazy, reverse pennant as a forecasting tool. I'm not sure you're going to find the "reverse pennant" in any books about TA but I'm quite sure that none of those books ever anticipated the end of the dollar, either.

Similar to silver, gold currently sits very close to the midline of the pattern. Note that the previous two occasions when gold broke through the midline (mid July and early August), gold proceeded to ride the upper trendline for about two weeks before falling back. IF gold can once again break through the midline, it will likely charge toward the top line again. This would take the price to near $2000. The OI numbers in gold are similar to silver, too. After peaking at 532,000 last Monday, total OI as of yesterday is all the way back to 501,000. A drop of almost 6% in one week!

Conclusion: We may be on on the verge of another massive rally in gold. Your signal will first be a move through yesterday's high of 1841.50 and then a burst through the midline, currently in the area around 1850. Should gold move conclusively through 1850, it should move to new highs in relatively short order and then continue to make new highs through mid-September.

WARNING: Don't go getting overly excited and carried away at this moment. Nothing is pending until the metals break through those midlines. The open interest numbers suggest that the breakthroughs will come in the next 24-48 hours. They may not. If they don't, I will continue to monitor these charts until they do.

I feel that this is pretty important info so I plan to leave it up all night as the lead, above-the-fold story. I will probably leave it up tomorrow, too. Be sure to refresh the homepage from time to time if you're looking for updates as they will be attached as addenda to this post. TF

9:15 EDT UPDATE:

Sort of a bland trade this morning. The metals tried to rally overnight but they were beaten back at the regular, appointed hour of 3:00 am EDT. It appears, at this moment, that the metals will struggle to trade higher today. 1841.50 is still acting as a resistance point for gold and silver has yet to reach 42, yet alone 42.30. Let's just sit back and watch and see what the day brings us.

A couple of other things...First, this silver update from GoldCore via ZH is worth your time:

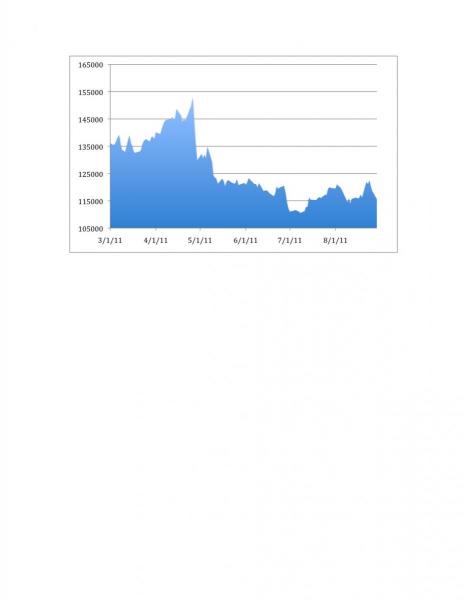

Second, a friendly reader sent me this chart of the open interest in silver since March. I have neither the time, inclination or technical know-how to superimpose the actual price of silver onto this chart. However, it would probably be a rather insightful thing to do. Anyone want to take a stab at it?

That's all for now. TF

10:50 EDT UPDATE:

This is certainly something to watch over the next hour or so.