Well, that was fun, wasn't it? What a day! I hope that you, my dear reader, had as much fun following the PMs as I did today. Now, get ready for tomorrow and, especially, Friday. As we approach the weekend, there is no doubt that things will get even more volatile.

There is a lot going on in the world and the PMs are going a lot higher. Let me explain. No, there is too much. Let me sum up.

1) France is on the verge of losing their AAA rating.

2) Italian banks are on the verge of collapse.

3) In the U.S., Bank of America looks to also be on the edge of the abyss.

4) The Fed signaled yesterday that rates will stay at zero for the next two years.

5) Rioting and civil unrest seems to be on the increase globally.

We were all watching The Cartel vigorously defend the 1770 level since Monday. Many smartypant shorts were watching, too, hoping against hope that the Forces of Darkness would not let them down. To their surprise (not mine), The Cartel failed and, once gold tripped by 1782, it quickly surged almost $20 to $1801 as all the smartypant bootlickers got squeezed and stopped. Predictably, gold has pulled back from $1800 as profit-taking set in. Equally predictable, The Cartel used some equity strength to sell gold on the Globex, too. The resultant dip stopped right on schedule at 1770 and gold has since solidified. I have a last of 1777. Look for another night of fireworks in Asia. If you doubt me, ask yourself what happened today to lessen overnight Asian demand. Anything? Nope. Look for gold to trade back to and, probably, exceed 1800 overnight.

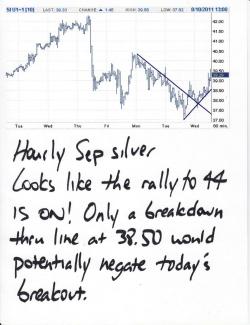

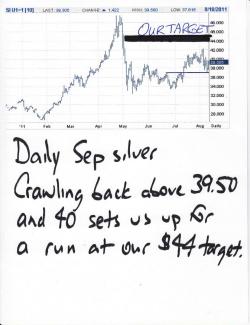

Silver is doing great, too. As discussed last evening, it appears that the bottom of the recent correction in the commodities was achieved yesterday. Looks for this rally to continue, in spurts, for the next 3-4 weeks. This will be a favorable environment for silver to return to an uptrend. The chart looks like a bottom was found yesterday and yesterday's OI was likely the low, too. All of this just makes me even more confident that silver will trade to $44 or higher before Labor Day in the U.S. (Monday, Sept 5).

I hope you are slowly making back some of the fiat lost back in May. My goal is to do a better job of helping navigate this latest bout of craziness. Be patient but be diligent. You now know that a desperate and wounded C/C/C can and will change the rules in their favor anytime they feel truly threatened. Be cautious but be brave. We are on the right side of the math, the facts and history. Now is not the time to be distracted by MSM pundits and shills who cling to the power that the status quo bestows upon them. Trust your instincts but do not get cute or get greedy. In the end, this is about survival, not profit.

More later if I can stand it. After today, I may need to shut the MacBook down for a few hours! TF

7:15 EDT UPDATE:

As expected, the criminal C/C/C just announced this evening a margin hike in gold, effective at the close of business tomorrow. Read more here:

https://www.cmegroup.com/tools-information/lookups/advisories/clearing/files/Chadv11-279.pdf

As you might expect, gold has pulled back on the news. After a high of 1818, it has pulled back to 1804. I doubt that big money Asian and European investors give a rat's ass at this point about Comex margins but you never know. Watch carefully this evening as this is sure to heighten volatility.

Though we all remember the 5 consecutive silver margin hikes in May, don't forget about the first silver margin hike last November. Silver corrected from $29 to $25 in five days but, as you know, it went on to double from there over the next six months.

TF