In the past 24 hours, we can now count four, separate attempts at the 1770 level by the December11 gold contract. We can also count four, immediate Cartel actions to hammer price back down. However, the lows are getting higher and the pressure is mounting. Will the Forces of Evil be able to contain gold through the night and into tomorrow or will they again be forced to retreat to higher ground? I suspect we will know very soon.

Take a look at these three December gold charts. I've tried to draw the same trendline on each. Note the savagery of the beatdowns as gold eclipses 1770. Santa warned us weeks ago that The Cartel also knows that 1764 is a very significant level and will thus defend it vigorously. They have and they are. Will they be successful? You'll know by following the trendline I've drawn and watching the triangle close. If I had to guess, our Asian friends also see this chart pattern and they will make a run at putting the EE into a submission hold later tonight. We'll see. It will be great theater.

Now, what I really wanted to talk about this evening is silver. I've scoured the internet for the most reliable and accurate analysis of today's events. I of course found it at Trader Dan's site. Please take a moment to read it and then come back. Go ahead, I'll wait.

https://traderdannorcini.blogspot.com/2011/08/s-500-update-us-dollar-sacrificed.html

Ahh, glad you're back. OK, where was I? Oh yea...silver. I've lifted the most important chart that Dan posted and re-printed it below. (Thanks, Dan!)

Notice that the CCI has averaged one big drop per month for the past five months. Each drop has lasted from 4-7 trading days and has been followed by a rather significant rally. The current drop just finished its fifth day and, with all of the hubbub from The Fed today, is almost assuredly going to bottom tomorrow if it didn't already bottom today. Anyway, my point is...we're about to see another 2-4 week rally in all of the commodities. Yes, copper, crude and the grains are going to rally. More importantly, I think we can feel very confident that silver is not going much lower, if at all. In fact, I bet we saw the lows today, in the beatdown on the Globex. So, from here, what can we expect? Given that silver rallied almost 25% in July, during the last CCI rally, I think a reasonable target for silver is $44 before Labor Day.

Adding to the ammunition are the utterly amazing OI numbers in silver. The latest numbers are basis Monday and show a total open interest of just over 114,000 contracts. We almost certainly lost a few more today. For perspective, the last time OI was this low was late June...right about the time the CCI bottomed!

So, there you go. I may look like a complete fool by this time tomorrow. Rigged and manipulated markets can do that to you. But, I'm sticking with it. $44 silver by Labor Day.

Have a great evening!! TF

10:05 am EDT UPDATE:

I do not have a new post this morning for two reasons:

1) I want to leave this current post as the "main story" for most of the day.

2) I'm busy watching an epic and breathtaking battle in the Dec11 gold contract.

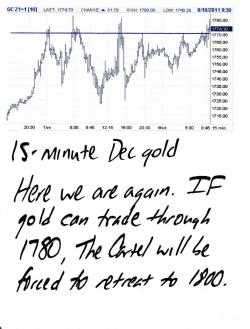

As I type, our side is winning but just barely. Watch the 1780 level very, very closely. Above there, The Cartel will be forced to give up and retreat to safer ground. It looks almost certain that this is going to happen. As I watch the order flow, the bids are very strong and unrelenting. The chart looks like it's about to squeeze them, too.

I've got a last of 1777. Stay close and keep your fingers crossed! TF

11:50 EDT UPDATE:

The global stampede of investors rushing into the safety of a 6000-year old currency has completely overrun The Cartel's defensive positions between 1770 and 1780. I have a last of 1789 in the Dec11. If headlines don't change in the next six hours, expect explosive gains in the overnight Asian trade, too. Personally, I'm darn glad I took off my spreads yesterday and went "open-ended". Looks like lots of gains to come!

Speaking of which, isn't it great to see silver participating...FINALLY! The chart below was printed before the recent surge through $39. Keep the faith. Silver looks great!

More as conditions dictate. TF

1:05 EDT UPDATE:

30 minutes to go on this historic day. Gold is $20 off its highs but I'm not at all concerned. In fact, the chart below might be one of my all-time favorites. All of the smarty-pant shorts who had faith that their evil Cartel buddies could hold the line at 1780 just got smoked! HAHAHA! Rather predictably, the "market" has given back the $20 it added on the back of the short's pain and that's OK. Nothing has fundamentally changed and its looking more and more likely that we'll head into the overnight session with " a lotta mo", just like Mr T!

Full update soon. TF