Weren't the looks on the faces of The Shill and The Coug absolutely priceless? "What? An upside surprise?" Look, we don't refer to it as the BLS"BS" report around here for nothing. The BLS has the ability, through their goofy and worthless statistics like the "birth/death adjustment" to make their monthly reports sing in whichever manner they choose. Sometimes the data is so bad that it's impossible to touch up. Sometimes, like July, when the markets need a boost and a shot of stability, the BLS is able to goose the numbers just enough to take some pressure off. I haven't seen the internals of the report yet but I am highly confident that, once released, it will be plain for all who care to see.

Tucked away in the comments section of the blog from yesterday afternoon was this:

"BTW, upon further review, any BLSBS number tomorrow should be positive for gold.

Bad BLS: Ensures QE3. Positive for gold.

Good BLS: Provides "stability" for stock market. PMs recover, too."

And I suspect that this is true. Though there will be volatility today, there should not be any of the abject panic that prevailed yesterday. As I type, the S&P is up 9 points or so and gold is off $2 at $1657.

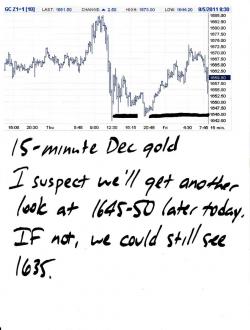

There are still plenty of reasons for the equities markets to be spooked, however. All of the funky stuff coming out of Europe should keep you checking the headlines this weekend. Expect more of the same into next week. Gold, having found a floor twice right near 1645, looks poised for a rebound next week. The question is the shape of the rebound. I suspect that, sometime today, we'll get one more push down toward 1645. Whether or not that level holds again will determine the shape of the short-term bottom. If I had to guess, I'd say it's 75/25 that 1645-50 holds for the third time and we rally higher from there. On the off chance it doesn't, I'll get my momentary drop to 1635. From there, I'd look for a rally and then a dip back toward 1645, giving us a cozy, little reverse H&S. The question for me is: Do I move my "stink bid" up to the 1645ish level or do I hope for the 25% chance of getting gold down to 1635. I'll keep you posted.

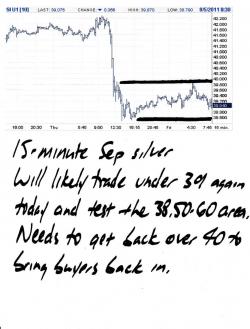

Silver is a similar deal, though the chart is flatter. I strongly suspect we'll get another look at 38.60 or so later this morning. Whether or not that hold is anyone's guess. I suspect it will but I would not rule out a quick dip that approaches 38. IF that were to happen, I'd be all over it. Unfortunately, yesterday's smash occurred just as traders were beginning to return to the silver pit. OI had finally broken through 120,000 but I'm sure we'll see it back under 120,000 when we get the numbers later today. Because of this, it will likely lollygag around between 38 and 40 for a while. You can bet your arse that The EE would be very happy to see silver contained in a little 38-40 box all the way through the Spetember "first notice day" later this month. For now, I'm just sitting on my puny, out-of-the-money silver spreads and waiting.

As I publish this, we've got a rally! S&P is up 14, gold is 1662 and silver is 39.30. Let's see what the morning brings. TF

12:30 EDT UPDATE:

For those of you who don't regularly check the comments, I apologize if you missed this:

Let's see if they goose the

Let's see if they goose the market a little bit before/around lunchtime. Maybe take the S&P down toward 1170-75. Perhaps create a momentary pukejob in the PMs. I'll try to buy that dip.

And this:

OK. That worked.

I got my pukejob. S&P held just below 1170.

I put on a 1700 vs 1800 spread in Oct gold and a 40 vs 45 spread in Sept silver.

I strongly suspect that the worst is over for stocks...at least for today. Don't be surprised if the S&P even moves back into the green this afternoon as dip buyers move in. The same should be true for the PMs. They will likely follow stocks back up.

More later this afternoon. TF