Yes, I know that yesterday and today (so far) have been very fun. Yes, I know that the summer doldrums typically end with sharp rallies that seem to come from out of nowhere. Yes, I know that it's tempting to get all excited. Please don't, at least not yet.

It is very important that you keep your emotions in check and not get ahead of yourself. As discussed here last week, the doldrums almost seemed designed to reclaim from you all of the profits you made during the last run-up in price. I know it is extremely tempting to buy this rally. Unfortunately, anyone buying here will likely get whipsawed, especially with the BLSBS report coming up on Friday. DO NOT forget that the Forces of Evil almost always raid the PMs in the 24 hours that precede the report. Please be patient. There will be plenty of time to get all worked up and long. The time is just not yet. Let the PMs do some technical damage to the bears first. Gold needs to break out and through 1550. Silver needs to best not only 36 and 38 but 39.50, too. This doesn't mean you can't trade in the interim but you have to buy dips and sell rallies if you're going to survive and that takes discipline and fortitude. IF you think you have sufficient quantities of both, the go for it. If not, my advice to you is to continue to wait, watch and learn.

GOLD

You can clearly see in these two charts that the rally, though powerful, has not changed the technical picture at all. Gold is simply moving within its summer range. When it finally breaks through 1550-60, then you can get excited. Until then, take profits when you have them.

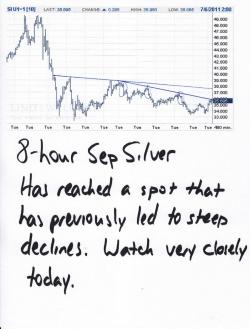

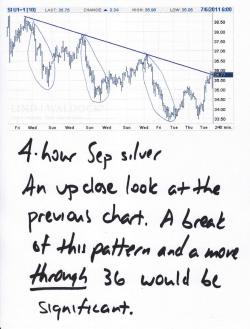

SILVER

Like gold, the rally has been terrific and, if you bought back on Friday like Mister Hyde, you've made quite a bit of jack. However, now is not the time to get greedy and let it ride. I told Hyde to take profits and I'd tell you to do the same. Keep your powder dry. Buy the next dip and sell the next rally until silver finally breaks back through $40.

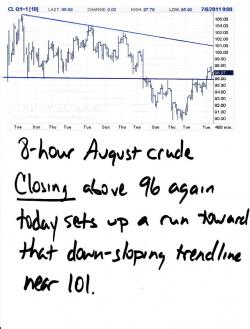

CRUDE

As you know, I was expecting crude to turn around, just not this quickly. I really didn't think that crude would be back above $96 until mid-July, at the earliest. That it is back above so quickly is great but it also makes the rally a bit unstable. Do not be surprised to see a dip develop that would take price back toward 95 or even 94. However, having bested the 96 level, crude now looks set for a run back above $100. As it does, it will cause us to create a new acronym...the FUBO. (I'll let you guess what that means.)

As I close, price continues to hang in there. Gold is 1529 and silver is 35.81. Let's see where this heads today but, again, beware the EE and there desire to raid pre-BLSBS. Have a great day! TF

p.s. I need your assistance with something. This site is designed with a positive feedback loop via the "hat tip" button. Please do not use it to promote yourself. Those of you who are "self-tipping" are ruining the value of a tool which is designed to allow the reader/user to measure the credibility of the author. Thanks for your help.