Frustrating? Yes. Complicated? Nope.

Well, it's good to be back though the timing of my spring break turned out to be challenging for it seemingly could not have come at a worse time. More on that below but, for now, rest assured that Turd is back on the watchtower and ready to fight.

Let's start again today with where we left off Friday. In that podcast thread, I implored you to go back and review this post from 3/1/14. Even if you did so then, you should do so again today because it's extremely important that we get on the same page:

https://www.tfmetalsreport.com/blog/5530/negative-gofo-and-rising-gold-p...

To summarize, here are a few of the salient paragraphs:

"The days of Central Bank gold leasing are almost over. Whether the CBs are "out" of gold or simply unwilling to lease what they have left for fear of not getting it back (from China), the CBs are not playing the gold leasing game like they have for the past 45 years. Again, for the past 24 years, GOFO rates were negative just 7 out of 5,000 days. Since July 8, 2013, GOFO rates have been negative for 98 out of 164 days or roughly 60% of the time.

Put another way, positive GOFO means "business as usual". Central Banks are willing to lease gold to the Bullion Banks. The BBs take this gold and dump it onto the futures market, using this scheme to contain, manage and suppress price. This worked perfectly until 2003 when demand and fundamentals overwhelmed this scheme for the next nine years and price rallied from $300 to $1900. Leased gold was continually dumped from October 2012 until late June 2013 and the resulting decline took gold back from $1800 to less than $1200.

But, now, negative GOFO is the new norm. Why? Because the CBs no longer have the gold to lease to the BBs. Without this readily available physical supply, the BBs are unable to aggressively manage price on a day-to-day basis and they are forced to stand down. Instead of daily 7:00 am London time price raids, we only get one per week. Instead of "waterfall" declines on the Comex, we get gradual and steady price increases."

And I concluded that post with this:

"This leaves us with this conclusion for traders and stackers everywhere:

Buy when GOFO is negative. Be cautious, sell or hold off on new purchases, when GOFO is positive.

Could it be as simple as that? Yes! It may very well be, at least for now."

Allow me to put this another way for you...

When GOFO is negative, physical supply is scarce. Because of this, The Cartel Banks have no gold to dump into the market to raid and jam price lower. Their only option is to be on the offer. All they can do is stand ready to absorb as much of the speculative buying pressure as they can each day, hoping to contain price and manage rallies.

Once GOFO flips back to the positive, this indicates that The Banks again have the ability to freely lease gold en masse. They then can utilize this gold to aggressively raid and sell in their attempts to paint the charts and force the spec money back out. Into this spec selling, the banks can buy back and cover many of the shorts employed earlier to contain price.

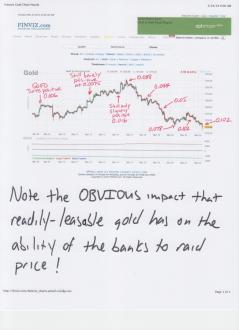

The two charts below illustrate this point. First, check this daily chart of the past two months of action. Just as the pattern has been, once Comex February deliveries began in earnest, GOFO turned negative again on 2/4/14. From there, gold went on a tear. It was UP 13 of 15 days with most days seeing an unusual lack of even London Monkey attacks. GOFO "peaked" negative on 2/21/14 and began to drift back toward positive as the February delivery month concluded, turning slightly positive again on 3/6/14. However, GOFO didn't immediately jump higher. Instead, it languished near flat for over a week as tensions in Ukraine/Crimea heated up and more speculators rushed into the paper market. As of 3/14/14, GOFO was still just slightly positive at +0.0075%.

Conveniently, we had a CoT survey taken on 2/4/14 as well. That evening, The Cartel Banks (gold commercials) were NET SHORT a total of 65,782 contracts. Left with no gold to raid price, all they could do was absorb spec bids through February and into March and by the CoT of 3/18/14, The Cartel Bank NET SHORT position had grown to 145,934 contracts. It was "mission accomplished" though because they had managed to contain the price rise to just $100. Can you even imagine how price would risen without The Banks covering each bid??

But, as you now know, GOFO did turn positive last week and each day since has seen rates move even deeper into positive territory. Again, this means that leasable gold is now readily available again for The Banks to borrow and dump into the market. GOFO moved from +0.016% to +0.038% last Monday. Can there be any surprise, in retrospect, that after price jumped higher last Sunday evening it was immediately raided back down and then lower later that day? As GOFO spiked toward a Friday high of +0.102%, are you surprised that price is now another lower?

Anyway, the good news in all of this is that we are clearly onto them. The game is ending, as witnessed by the now-persistent negative GOFO and, with April Comex deliveries set to commence in a week, rates will undoubtedly slip negative again soon. In the meantime, we must expect even lower prices as a desperate Cartel attempts to paint the charts as negatively as possible while they can, hoping to avoid another spec rush in April.

In gold, this means at least a drop to the lower end of the 2014 channel, currently near 05. However, I doubt that price will stop there. The Cartel goal almost has to be to break the 2014 channel. Why would they want to leave that channel and bull trend intact for when GOFO slips negative again next month? No, they'll almost certainly keep raiding until that channel is broken. Also, if they can break price down and out of the channel, they'll also try to knock price back below the 50-day and 200-day moving averages, currently near 02. In the end, absent any geo-political dramatics over the next 5-10 days, I think price is headed to 80 or so and the 100-day MA. Yes, that stinks but it is what it is.

And silver, now that it's convincingly back below .60 and all of its moving averages, is likely headed to at least .50. I'd love to see a third "higher low" by having it stop there but we can't rule out , either. Yes, that sucks. But, again, recognize it for what it is and prepare to take advantage of this current dip.

I have a lot more to say but I'd better get this posted. I'll try to cover this and other topics in more detail in today's podcast so please be sure to check back later.

Again, hang in there. Recognize what is going on and use this knowledge to your advantage.

TF