As we await the FOMC Fedlines tomorrow, time for another math lesson.

So I'm laying in bed last night, flipping through the channels and I stumble across Fox Business News. I usually stop there as I flip by because they regularly cycle the current gold price in the lower right hand corner of the screen. As luck would have it, Neil Cavuto (who is kind of a douchebag) was just beginning a segment with David Stockman, the former Budget Director for President Reagan and author of this great new book.

Anyway, I start watching this and, before long, I find myself talking back to the screen, even raising my voice from time to time. First, Cavuto is infuriating to deal with. His douchebaggery permeates his interview style and keeps Stockman from elaborating on critical points. However, what really drove me crazy was the avoidance of the main point. The United States is at the terminal stage of its debt and deficit financing. The only remaining method of maintaining The Great Ponzi is record low interest rates combined with extremely short maturities. If rates were allowed to return to "normal" and if the U.S. were to prudently spread their debt obligations across the yield curve, the budget line item "interest on the national debt" would simply swamp and overwhelm the entire federal budget.

First, before we continue, here's the clip of Cavuto and Stockman:

Fortunately, for all of you that are math-challenged, this isn't complicated. Here are two charts of the national interest cost that I found at this website: https://www.treasurydirect.gov/govt/reports/ir/ir_expense.htm. First, here's the breakdown month-by-month of interest paid so far in fiscal 2013:

Interest Expense Fiscal Year 2013

May $24,378,480,861.09

April $35,951,751,963.63

March $23,472,400,737.30

February $16,901,310,565.17

January $17,816,590,831.57

December $95,736,594,801.52

November $25,068,968,472.99

October $12,922,741,407.27

Fiscal Year Total $252,248,839,640.54

The interest expense varies from month to month because of the maturity and coupon schedule. The main point to note is the total. Through 8 months, the total interest is about $252B. Now remember, in the previous post, I showed you that the total deficit so far this year, which includes this interest line item, is about $626B. Projecting forward, fiscal 2013 will likely come in at an interest cost of $350B or so and a total deficit of around $1T.

Now take a look at the total interest cost broken down by year since 1988. This, too, was taken off of the treasurydirect website.

Available Historical Data Fiscal Year End

2012 $359,796,008,919.49

2011 $454,393,280,417.03

2010 $413,954,825,362.17

2009 $383,071,060,815.42

2008 $451,154,049,950.63

2007 $429,977,998,108.20

2006 $405,872,109,315.83

2005 $352,350,252,507.90

2004 $321,566,323,971.29

2003 $318,148,529,151.51

2002 $332,536,958,599.42

2001 $359,507,635,242.41

2000 $361,997,734,302.36

1999 $353,511,471,722.87

1998 $363,823,722,920.26

1997 $355,795,834,214.66

1996 $343,955,076,695.15

1995 $332,413,555,030.62

1994 $296,277,764,246.26

1993 $292,502,219,484.25

1992 $292,361,073,070.74

1991 $286,021,921,181.04

1990 $264,852,544,615.90

1989 $240,863,231,535.71

1988 $214,145,028,847.73

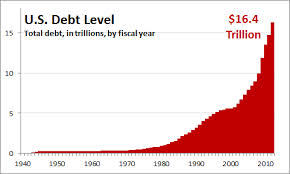

And also consider this chart:

And this is where you stop me and say: "Hey wait a second, Turd. How the heck does this work? Back in the early 90's, the total debt was just a quarter of what it is today but the interest costs were almost the same. Even as recently as 2005, the debt was half of what it is today yet the interest cost was the same."

It's quite simple, really. Since the early 90's Clinton Administration, the policy of the Treasury Department has been to shorten the average maturity of the total outstanding debt. Why would you do this? Think of the "yield curve". A "normal" yield curve slopes positively, as bond yields increase over time. So, the shorter the maturity of the bond, the lower the interest rate.

Additionally, since 1994, The Federal Reserve has aggressively maintained a very low interest rate policy. The side effect of this policy has been the rapid inflation of the tech and housing bubbles. However, the main goal of this policy has been to provide financing for the federal debt and deficit at the lowest interest rate possible. And it has worked!

Therefore, by continually shortening maturities and issuing and refinancing debt at lower and lower interest rates, the "interest on the national debt" has been remarkably stable for nearly two decades.

But here's the problem that Cavuto and Stockman failed to cover: The jig is up. Rates can't go any lower and the average maturity of the outstanding debt can't get much shorter. We've reached the terminal stage and now we have a major problem on our hands.

The only reason that rates remain as low as they are is consistent Fed involvement in the bond market, to the tune of $85B/month. Should The Fed remove or "taper" some of that bond buying, interest rates will rise. Why? Less buyers of treasuries means that prices will fall. Falling bond prices mean higher interest rates. It's no more complicated than that.

And what if rates were to rise? Though admittedly an oversimplification, let's look at it this way:

For fiscal 2013, the U.S. will pay interest of $350B on a debt level of about $16T. That's an average interest rate of about 2.2% with an average maturity of around 5 years. Oh my goodness. (https://www.treasury.gov/resource-center/data-chart-center/quarterly-refunding/Documents/TBAC%20Discussion%20Charts%20Feb%202012.pdf)

Hmmmm. Now let's remove The Fed from the picture. That's what everyone seems to be expecting nowadays. Without direct Fed intervention, interest rates will rise. (I would say that they will rise substantially as we already know that foreigners are aggressively selling treasuries as it is. (https://www.zerohedge.com/news/2013-06-14/treasury-sales-foreigners-hit-record-high-april) Can you imagine the rush for the exits if rates are rising and bond prices are rapidly falling?) If rates were allowed to "normalize", what would be the average interest rate on the federal debt once it's all refunded and rolled by 2018? Well, again by simplifying the math we get:

$20T (2018 debt level) X 5% average rate on a 5 year average maturity = $1,000,000,000,000 per year

So, if rates are allowed to rise and normalize, the line item "interest cost of the national debt" will be equivalent to the entire national deficit of fiscal 2013.

With the continued growth of entitlement and defense spending, the entire federal deficit for 2018 would be $2T, at a minimum. And from where do you think all that funding will come from? Continued and increased demand from creditor nations such as China, Japan and India? Not likely. $85B/month in Quantitative Easing would have to be increased to $170B/month. Do you see now why we call it QE∞?

In the end, as the title of this thread states, we have reached the terminal phase of our debt-induced, deficit spending and growth economy. Rates can't go much lower and the Treasury can't shorten maturities much farther. Their only hope is to maintain and sustain, propping up The Great Ponzi and maintaining power for as long as possible. In this environment, any move by The Fed to "taper" QE would be very short-lived and done for appearances only. The only option is ever-increasing QE, to infinity. Your only financial protection against the eventuality of devaluation and collapse is the acquisition and storage of physical precious metal. Buy some more today, while you still can.

TF