With the holiday yesterday, I figured that today would be either Happy or Terrible. I sure didn't expect this snoozer.

Even though the U.S. economic data was lousy today, the metals seem stuck in neutral. Oh well. Actually, it's kind of nice, for once. A nice, bland and boring day...so far. However, I'll be watching for that same, evil Globex algo to rear it's ugly head at around 1:00 EST. Let's see if gold then drifts lower into the close and loses another $6-8 between 1:30 and 4:00.

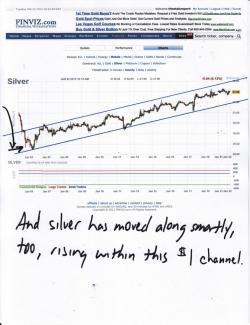

Here are some charts as you start your week. First up, here are the hourly finviz charts. Note that since the miserable, contrived beatdown of 1/3-1/4, both metals have moved up nicely, contained within broad, upward-sloping channels.

And these daily charts that I printed yesterday neatly summarize where we are in the bigger picture:

OK, here are some other, random items...

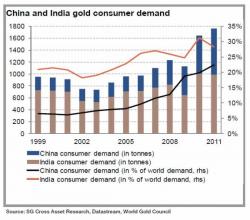

Anyone following along in the comments to yesterday's thread would have seen this story already. It seems that the Indian government would like to discourage gold investment by its citizens. As ZH rightly points out, with items like gold, you often get the opposite effect. If anything, the post contains a very instructive chart that I've copied below. https://www.zerohedge.com/news/2013-01-22/india-scrambles-make-gold-purchases-ever-more-difficult-hikes-import-tax-and-duties-

While at ZH, I found this fantastic new piece from JS Kim. I agree wholeheartedly with many of his conclusions, particularly the ones about "financial advisors". Though there are a very select few out there who "get it" and are actually trying to help their fellow man, most are simple snake-oil salespeople who are driven by commissions and fees. Years of self-reinforcing behavior have convinced them that they are the smartest people in the room and that their "advice" is valuable and worthy of your hard-earned dollars. https://www.zerohedge.com/contributed/2013-01-22/one-chart-explains-massive-risk-investing-gold-gold-stocks

Earlier today, The Doc (who isn't sleeping much these days so he has some extra time on his hands) posted this first-hand account of metal demand in China. Admittedly anecdotal, it nonetheless tells a story you simply won't hear anywhere in the MSM. https://www.silverdoctors.com/first-hand-account-of-gold-silver-mania-in-china-black-friday-style-mobs-scrambling-for-bullion/

And here's another reminder...Paul Coghlan is hosting a FREE charting webinar again tomorrow. The one last month received rave reviews for its value so I would encourage you to sign up. Like the previous one, this webinar will also be recorded and posted for later review if you are unable to watch it live. However, you still have to register to view it. You can do so by clicking here: https://www1.gotomeeting.com/register/499274952

And, frankly, that's it for today. Short and sweet. As I wrap, I see that the metals are moving a bit higher. This is nice but they need to sustain these moves. Silver is still battling its 50-day moving average, currently near $32.04 on the Mar13 contract. Besting that, its next goal is horizontal resistance and the 100-day MA near $32.65. Gold, too, is butting up against its own 50-day, currently near $1697 on the Feb13. Keep an eye on those levels with crossed fingers.

Have a great day!

TF