First, I thought it'd be crazy. Then, by Tuesday, I thought it'd be dull. It turned out crazy. Just another week in the life of a Turd.

What did we see:

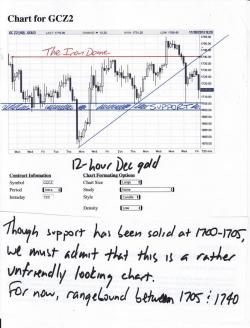

- After the price surge of Black Friday, prices were pinned below $1750 in gold through option expiration on Tuesday.

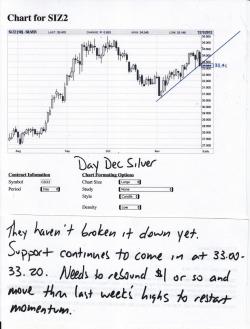

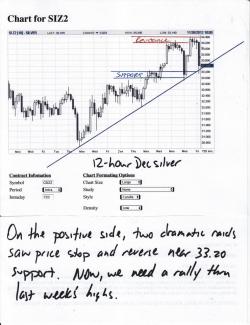

- Significant raids related to First Notice Day on both Wednesday and Friday.

- Robust support appeared where we'd like to see it, namely $1705 in gold and $33.20 in silver.

- On a personal note, I had a very successful week, after being notified that I was at once "retarded" and "dangerous". This comes just a few weeks after finding out that I am "morally bankrupt". Winner, winner, chicken dinner! That's the trifecta!

Before we look at the setup for next week, let's look back at yesterday so that we all can get on the same page regarding the mechanics of the selloff. Without doubt, the action of Wednesday and Friday was directly related to First Notice Day and contract expiration of the Dec12 gold and Dec12 silver. An overly-simplified way to explain this is:

- Bad Guy Bullion Bank builds up a very large position in the Dec12. BGBB is both long and short the Dec12 because the BGBB has taken turns, alternately buying and selling, in its attempt to pin price at a certain level for a minimally-damaging option expiration.

- Once Dec12 options expired at the close on Tuesday, BGBB needs to close all of its long and short futures positions in the Dec12.

- An entity without nefarious intent would simply liquidate both sides simultaneously and close the positions.

- Instead, the BGBB manipulates price for its own benefit by completely dumping the long side onto the market.

- This drives price sharply lower and initiates HFT-momo algo selling which drives price even lower.

- Into this HFT selling, the BGBB gradually covers the short side of its Dec12 position.

As it was happening yesterday, I printed these five charts. Note that the downward action was entirely contained within the metals. Other "risk" assets like crude or stocks or the euro were relatively stable and unchanged. Below are mid-day, five minute charts:

The resulting effect accomplished three, critical objectives for the BGBB.

- After all the selling, price is reset $20-30 lower and the chart looks unfriendly.

- Crushing price allows the BGBB to exit its entire position in a more profitable manner than if they had simply covered the thing at the market.

- All of the downside volatility frightens and coerces the longs, who might have considered delivery, into dumping, instead. This selling is also used as prey for the BGBB to cover the short side of its spread.

So, here we are. All of that nasty expiration and FND stuff is finally behind us and we're ready to roll into December. In the end, I expect this to be a very nice and positive month that will set us up for a big, exciting and explosive 2013. Getting there, though, will likely be volatile and challenging. To begin with, though the silver charts still look pretty good and silver remains above all of its moving averages, we'd be kidding ourselves if we thought the gold chart looked equally fine. It doesn't. So, first and foremost, we need to hold support early next week and begin a move back toward $34.20 and $1740.

Just a couple of "housekeeping" items before I knock off for the weekend.

First, yesterday's CoT was unremarkable as it once again showed that all the specs were buying and all of their buying was absorbed by the Cartels. Just once I'd like to see a nice, fair and even mix. Here's reprint of the comment I posted into yesterday's thread:

This week's CoT is just another sickening example of bullion bank control. Wait until you see the math.

GOLD

For the Tue-Tue reporting week, price rose by $19 and total OI expanded by 5,244.

Large Spec Net Long change = +12,927

Small Spec Net Long change = +3,056

Total Spec Net Long change = + +15,983

Cartel Net Short change = +15,983

Enough said.

SILVER

For the reporting week, price rose by $1.05 and total OI rose by just 392.

Same shit, different shiny metal.

Large Spec Net Long change = +772

Small Spec Net Long change = + 834

Total Spec Net Long change = +1,606

Cartel Net Short change = +1,606

The Cartel net short change was almost equally divided between covering longs and adding new shorts. The total Cartel gross short position is now 99,317. This is the highest level I can ever recall seeing. The last time total OI was this high on October 2010, the Cartel gross short position was 92,150.

And this is interesting...Back in October of 2010, the net short ratio of The Silver Cartel was 3.07:1, with price near $26. The Cartel was short 92,150 and long 30,023. As of last Tuesday, with price near $34, the gross Cartel short position was 99,317 but the long position was 40% higher at 42,525 for a ratio of 2.33:1. The only real difference, besdies price, between October of 2010 and today is this:

The Cartel gross short (+7000) and the Small Spec gross short (+4000) is nearly equal to the rise in Cartel gross longs (+12,000).

Next, if you haven't yet signed up for the free webinar on Wednesday, you really should do so. It's scheduled for Noon EST and will be recorded for replay if you can't make it at Noon. Not only will Paul Coghlan be speaking and demonstrating his technical analysis, but our pal Andrew Maguire has promised to make an appearance, as well. Just click this link to register: https://www1.gotomeeting.com/register/240678176

And here's something on which I need your feedback. We have the opportunity to construct our own, "private label" bullion and coin store. It would be directly linked here but the guts of it (the infrastructure) would be an already-existing bullion and coin service. Call it the "TFMetalsMart" or something. My questions are: Is this a good idea? If the pricing was fair, would you buy from it? Would this seem a conflict of interest in that I'm such an active promoter of stacking physical metal? Please use the comments section of this thread to share your feedback.

Lastly, if you consider yourself an outstanding "prepper" or a "survivalist"....if you are prepared for anything, willing and capable of living off the land...and if you are competitive by nature, please send me an email at turdistheman at gmail dot com. I may have something for you to consider. Serious inquiries only please.

OK, that's it. We survived last week and, though we're damaged, we're still battling and expecting big things ahead. Go now and relax but return on Monday, ready to continue the fight.

TF