This has been a crazy, discombobulated morning. You need a new thread but I don't have the time to give it the attention it deserves. Here's a start and I'll add more later.

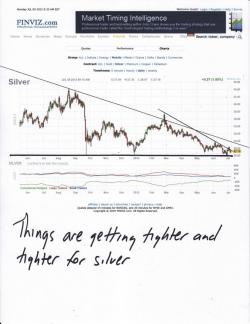

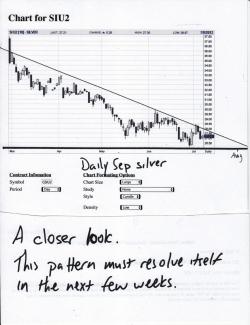

First of all, the charts I printed about 3 hours ago. Note that gold is basing within a pennant. Note that silver remains trapped in a descending triangle that will be closing very soon.

Check out these two links from ZH:

https://www.zerohedge.com/news/perfect-storm-santelli-meets-farage

https://www.zerohedge.com/news/effects-increasing-global-money-supply-gold

And our pal Ned was on CNBC Europe again today. He did a masterful job of handling the moronic talking heads while still inserting all of his points regarding the ongoing manipulation of the metals. He sent me the link via email. Here's the response I sent back:

1) That woman anchor is hopelessly clueless.2) "Bold proclamation" guy seems like a real tool.

3) I think the chick to your right has the hots for you

4) The guy in the striped tie is a complete idiot

5) All-in-all, just goes to show how far we have to go...

And here's the CNBS link:

https://video.cnbc.com/gallery/?video=3000100465&play=1

That's all for this moment. I'll update after the CoT from last week finally gets released at 3:30 EDT...about 2.5 hours from now.

TF

4:30 p.m. EDT UPDATE:

The latest CoT is finally out and....it sucks! When reviewing the data, keep in mind that the survey was taken almost a week ago, at the Comex close on 7/3/12. Also keep in mind the price action leading up to the survey.

Friday 6/29: Gold up $54 and OI up 1,600. Silver up $1.32 and OI down 1400.

Monday 7/2: Gold down $6.50 and OI down 600. Silver down $0.11 and OI down 700.

Tuesday 7/3: Gold up $24 and OI up 9,200. Silver up $0.78 and OI down another 500.

So, for the three days immediately preceding the report, gold was UP over $70 and its total OI rose by over 10,000 contracts. Silver was UP $2 and its OI only rose by 200 contracts.

In hindsight, are any of you surprised that the metals got smashed on Thursday and Friday???

Here's the sucky data:

GOLD

For the week, the large spec sheep added a net long of 14,500. The small spec baby sheep added a net long of almost 8,000. The all-knowing, omniscient Cartel added net short 22,500 contracts! The crooks sold a mere 800 of their longs, bringing the total long position to 154,926. However, they added 21,674 new shorts! They grew their total short position by 7% in one week!!! SEVEN FREAKING PERCENT! IN ONE WEEK!

Clearly, all of their mining clients decided to hedge, all at once.Clearly, they innocently added to their short positions which, of course, is a balance of long positions somewhere else on the planet.Clearly, they're very smart and just got lucky this time as the market sold off on Thursday and Friday.- Clearly, these collusive, criminal bastards absorbed the buying early in the week by issuing new paper shorts. They then proceeded to rig the takedown on Thursday and Friday.

And now you know how/why an 80,000 NFP can be translated into a PM selloff.

SILVER

Very disappointing. Keep in mind that, for the reporting week, total OI fell by over 4,000 contracts. We lost the majority into First Notice Day of the July12 and then were stable. The large spec and the small spec shorts covered nearly 6,000 contracts. I guess we know who was short into contract expiration and then had to cover. There's your explanation for the $1.32 rise on 6/29. The real downer is The Silver Cartel. After reaching a have-to-be-a-misprint net short ratio of just 1.25:1 on the 6/26 CoT, The Evil Empire pitched 2,788 longs and added 2,555 new shorts. This brings their cumulative net short position to 17,350 contracts (pretty much all JPM per Uncle Ted) and a new net short ratio of 1.38:1. This is still a very bullish ratio but the fact that they are so aggressively adding shorts here (at $28, for pete's sake!) is a bit unnerving. This is a serious warning flag for that potential run at the sellstops below $26. A serious warning flag. Again, I'm not saying that it has to happen and physical supply is so tight that it would seem improbable. However, the prospect of harvesting stops below $26 has to have the EE salivating and the fact that they added so many new shorts last week has me very concerned that they are preparing to give it a go. Be cautious and don't be caught off-guard!

That's all for today. I need to go record a podcast where I'll go into more detail. Hang in there everyone.

TF