And why do I get the feeling that next week is going to be even more wild??

Before we get started, I thought I'd give away one more hat. I'm sure you've noticed by now that, once again, the financial world seems to be staring into the abyss. Of course, though, with all of da diffewent and scawey tings dat CNBS could tawk about, they instead are all-Facebook, all-the-time. So here's the new contest: On what day will the closing Comex price of an ounce of silver exceed the NASD closing price of Facebook? Please use this thread to log your guesses and I'll close it to new entries on Monday morning. (and can someone please log all of the guesses onto a spreadsheet? please??)

Great follow-through in the metals today. As you know, I was expecting this rally but I was also expecting a brief pullback and double-bottom. We didn't get that and that's a very good sign. Additionally, I was expecting a somewhat flat OI change for yesterday and boy-oh-boy was I wrong there. In the near $40 rally yesterday, total OI expanded by 17,000. WOW!

So, what's the deal? Well, there was certainly the short-covering that we talked about. However, there was obviously a HUGE surge in new longs, too. It's almost as if a spec short not only covered that contract, he/she/it then turned around and went long. This is GREAT NEWS. But 17,000 cannot be written off solely to this idea. Clearly, brand new longs came into the picture and who are they? In my opinion, most likely The Cartel. Adding longs to start the short squeeze but likely adding even more later in the day. As usual, we won't really even be able to make an educated guess until next Friday's CoT but this sure seems plausible right now.

On the other hand, silver OI from yesterday was exactly as predicted. While price was jumping 83c, total OI rose by just 100 contracts. Here's your pure short squeeze. Longs add new, shorts cover old, net effect is no change.

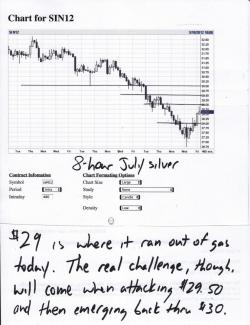

Again, though, the fact that we continued to add to the gains today, moving through expected resistance at 1580 and $28 is very encouraging. We eventually ran out of gas near more serious resistance of 1600 and 29. That's OK. It's perfectly normal for a few folks to ring the register after such a strong move, particularly ahead of a weekend. Let's wait and see what happens Monday. To that end, here are your charts. Note the steady climb higher on both of the hourly charts. Also note the next levels of resistance. In gold, once 1600 gives way, the serious battle will be near the intersection of horizontal resistance around 1625 and the 2008 trendline in the same area. Expect quite a fight. In silver, though 29 may offer resistance again early next week, I think the main battle will be between 29.50 and 30.

It's now 3:35 EDT on Friday and the CoT was just released. As expected, it's fantastically bullish once again. For the week 5/9-5/15, the Gold Cartel reduced their net short position by 12,538 contracts. This gives them a net short ratio of just 1.81:1. That's as low as I've ever seen it. On the flip side, the easily-manipulated large specs reduced their net long situation by 9,161 and the small specs reduced by 3,377. The lambs were led to slaughter. This report undoubtedly marks the bottom in paper price.

The silver CoT saw similar action. The Forces of Darkness reduced their net short position by nearly 2,000 contracts and their net short ratio now stands at 1.35:1, which is almost exactly how low it was at the price bottom of late December. Like gold, both large and small specs were selling longs and adding shorts. Though, I had hoped for a bigger drop in the EE net short ratio, given the tiny change in total OI for the reporting week, the 2,000 contract drop is pretty good news and confirms that, like gold, the silver price likely saw its lows this week.

OK, here's some reading material for your weekend. First, Eric Sprott was on KWN today. You should, of course, give this your consideration. https://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/5/18_Eric_Sprott_-_Governments_Frightened_of_Panic_Liquidation_Event.html

And then there's this. Turdite "tabberto" turned me on to this author, Detlev Schlichter. His book and this column discuss what we shall loosely call "the gold standard". I plan to be discussing several "gold standard" ideas in the coming weeks, so this seemed like a logical homework assignment for you. https://papermoneycollapse.com/2012/05/by-abandoning-the-gold-standard-we-embraced-monetary-central-planning-chaos/

We're also going to be spending time discussing backwardation as this has become a near-constant condition on the metals markets, particularly silver in the spot vs futures area. I found this study from 1999 linked on Harvey's site a few nights ago. If you've got the time and the mental energy, give it a look. https://www.fame.org/PDF/Howe_War_Against_Gold.pdf. Of course, the seminal piece on backwardation can be found here: https://fofoa.blogspot.com/2010/07/red-alert-gold-backwardation.html

That's all for now. I hope everyone has a safe and relaxing weekend.

TF