HAHAHAHAHA! That's a good one! As if having the Fed overtly printing money would solve all the worlds ills.

Once again the media incorrectly spins today's FOMC minutes as a postponement or even a (gasp!) cancelation of further quantitative easing. Buy the dollar! Your evil Sith masters are such responsible stewards of the economy that they are prepared stop the presses and enforce credit discipline upon a spoiled, bloated populace.

What a joke. Up goes the dollar and down goes nearly everything else. Please, I hope you are able to see through the fog of this nonsense. Again I ask you, from where is this year's $1.5T U.S. budget deficit getting its funding? From where did the U.S. government get their funding last year? From where will they get it next year?

Oh, whatever. I'm not going to go through all this stuff again. QE to infinity is the only possible option, whether or not Maria Headiromo and Bob Pissonme agree makes no difference, whatsoever.

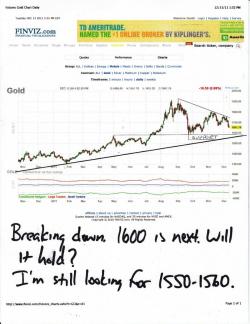

Anyway, back to important matters. I trust that the continued weakness in the metals is not catching anyone by surprise. Nothing has changed from yesterday or last week and the selling continues. Gold looks almost certain to head toward its 200 day moving average near 1615 and silver looks to be headed to 30. The big question is:

WILL THEY STOP THERE?

Maybe. However, I've got a sneaky feeling that they won't. I suspect that we will see a capitulation in paper selling when gold doesn't stop at 1610 and silver doesn't stop at 30. I've maintained for some time now that paper gold was vulnerable to a drop to 1550 and that paper silver could drop toward 25. Why change that forecast now?

I just saw the OI numbers for yesterday and they are very interesting to say the least. The Feb11 contract only saw its OI drop 1500 contracts. For a drop in price, this is an extremely surprising number. First of all, this nearly confirms for me that much of the front-month trading is done by WOPR. There seem to be very few, human holders of these contracts. Also, it's clear that much of the decline yesterday was due to the initiation of new short positions by The Cartel. Again, with lease rates at -0.5%, this shouldn't surprise anyone. The BIG story is the rise in Dec11 open interest by a net of nearly 500 contracts, from 1545 to 2034! The question is: Who is jumping the queue and why? Is global demand for physical metal this month finally going to be sufficient to explode the Death Star? Is this why The Cartel has desperately suppressed price over 0 in the past 3 months? I sure can't wait to see what tomorrow's numbers are.

As I wrap up, gold is 1633 and silver is 30.65. I sincerely hope that the discussions here over the past week have helped prepare you, financially and mentally, for this brutal selloff. Keep the faith. The only thing truly declining in value is paper gold and silver. I say this with confidence because thephysical gold and silver you have in your possession is invaluable and thus insulated from the day-to-day shenanigans of the paper market.

I'd like to type more but the LTs are planning a birthday party tonight for Taylor Swift and I have to go bake a cake. I hope to have more commentary this evening. TF