Hello there. Sorry I was AWOL yesterday. I had lots and lots to do plus I needed a break. I didn't open my Lind-Waldock account all day. Also, I wanted to leave the last post from Thursday up all day so that as many as possible would read it. I guess it worked as the total is now approaching 10,000.

First of all, before we consider the events of this week, please go back and read this:

https://www.tfmetalsreport.com/blog/643/interesting-next-two-weeks

Of course, dumdumTurd didn't heed his own advice and instead bought some August 1550 gold calls on Tuesday. Turd dumdum gets no gumgum after getting squished like grape.

So, where do we stand now. Without question, we are now into the summer doldrums...a 6-8 week period of downward consolidation. Please don't despair. As predictable as the comings of the doldrums are, so, too, are the endings of the doldrums. As we go through the summer, the assertiveness of the top-callers and the shrillness of the trolls will only increase. Please ignore them. Their only goal is to get you to sell your insurance and protection at the time when you need it most. By mid to late August, the precious metals will be ready to resume their UPtrends, right on schedule. Please be ready. Do not waste your time, energy and money trying to call bottoms before then.

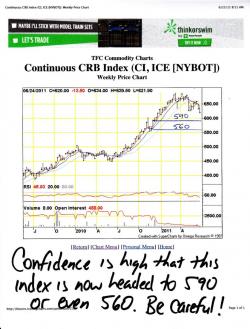

First up, here's an updated CRB. In the note from last weekend, we discussed how perilous the chart looked here and how it needed to rally. It didn't. The index now looks certain to test the 590 area, if not the 560 area, over the next few weeks.

Here is your weekly gold chart. Take note of two very important items.

1) The trendline from the beginning of QE in March 2009 is all the way down near 1400-1450, depending upon how accurately you draw it.

2) As discussed ad nauseam, gold reverts back to the trendline once every six months or so. Again, the pattern is clear: Four months of rally, two months of consolidation. Four months of rally, two months of consolidation. If you believe as I do that QE can't and won't ever end, then why would you expect this pattern to change?

And here is silver. It's catching a bid near the trendline from the August breakout but I don't think it will last. As described in the previous post, I expect silver to be rangebound, too, all summer long in an area bounded by 31.50 on the downside and 39.50 on the upside. Actually, it will spend far more time closer to the downside than the upside. That said, once the rally re-commences in the fall, I still expect silver to rebound to near $50 before the next consolidation phase begins in January 2012.

OK, onto a couple of housekeeping items. We are keeping a list of all the best ideas for site improvements. So far, we like the idea of private messaging and specific user searches the best. As we approach our one month anniversary next month, the plan is to submit the changes to a vote. We'll offer you 3-5 of the best "enhancements" and we'll implement the top vote-getter. Depending upon the cost, we may have to have a "fund drive" to pull it off but the goal is to make this site as user-friendly as possible.

Please allow me to respond to a couple of "troll-like" complaints:

1) The site has too many ads. Really? Really? The are three. That's it. Gimme a break. Have you ever run a website before? Do you know how much it costs every month for servers that don't crash? Do you think the "technical support and management" is free? Gotta make some revenue somewhere to cover these costs and the ads are how we do it.

2) Turd was too cheap to allow for "threaded" comments. Yes, I am cheap but that's not the reason. There are no threaded comments because I wanted to make it as hard as possible for two squabbling Turdites to hijack a thread with their arguments. Simple as that.

3) Turd's only been right once or twice so I'm outta here. Good, don't let the door hit you on the backside as you leave. I never promised anyone 100% accuracy and, if that's what you're here for, I don't want you here anyway. I try to provide my "guidance" on future price but this site is now about the collective knowledge and wisdom of the entire community. Sure, read my stuff but you must also sift through the forums from time to time. If you're not doing that, you're cheating yourself out of a lot of good info and fun.

Here is some light reading for your weekend. Don't worry, there won't be a test on Monday.

First, if you missed the latest from Mike Kreiger, here's a link. Pay particular attention to the quote from Larry Lindsey at the top. Sounds just like The Turd, doesn't it? (No, The Turd is not Larry Lindsey.)

https://www.zerohedge.com/article/mike-krieger-widespread-panic

Next, this writer does a pretty nice job of summing up why we are all preparing for "the end of the great keynesian experiment":

https://www.americanthinker.com/2011/06/our_wiley_coyote_moment_has_arrived.html

I do not agree with all that is stated in this next piece but that doesn't mean it's not worth reading:

https://lewrockwell.com/orig11/west-j2.1.1.html

I do, however, agree with most of what Mark Steyn writes:

https://www.steynonline.com/content/view/4131/26/

Lastly, I received this email earlier this week. The author asked that I share it with you. I am really excited for him and his project looks really cool. Check it out!

Hey Turd,

I'm a computer games designer from Scotland, living in Hamburg Germany. I've been following your posts religiously since you used to be a frequent commenter at zerohedge. Thanks to you and others like you, I'm in Physical silver and gold (very easy to do here in Germany).

Since learning about the likely outcome of the Great Keynesian experiment, I left my job to start my own games studio (I made a really terrible wage-slave and was bored of making inane content), with the goal of making a highly accessible browser game that would help awaken people about where we are headed. Games are amazing at doing this, as instead of being told about 'it', you are actually doing and experiencing 'it' for yourself.

The teaser web page is here: https://www.greedion.com it's a free-to-play game.

I hope that the game makes the people that play it a bit more open to hearing something other than the MSM crap. The game will have a forum and will link to tfmetalsreport and zerohedge. I am not sending you this message to try and get you to do the same, since your audience is already wide awake and likely not interested in playing games.

I just want to let you know what I'm doing, since you, Tyler and Alex Jones (he's a bit crazy, but his heart is in the right place) helped me to understand what is going on in the world and how best to prepare for when the SHTF.

Keep doing what you're doing. All the best,

J

I hope that everyone has a fun and restful weekend. See you on Monday! TF